Thanksgiving is upon us, and with that, many people take the time to reflect on the things they are thankful for. I, for one, am thankful for the health and happiness of my family, especially our newest member, Piper (our Havanese puppy). Beyond that, I am thankful for the ability and means to help others, which can mean financial planning to help someone save money or through the ability to donate to my favorite charity. In light of that, here are four ways to give thanks and save money at the same time.

1) The old fashioned way – donate cash. Charities can always use cash to fund their budgets and cover their expenses. It is as simple as writing a check or a few clicks on their website. Remember to keep your receipts though so you can deduct your contribution on your tax return if you itemize.

2) Donate old stuff. Places such as Goodwill and Salvation Army will take your old clothes, furniture, electronics and more as a donation. Make sure you ask for a receipt and properly document all the things you have donated. You can use this handy IRS valuation publication to calculate what your items might be worth if you intend to deduct the donation on your tax return.

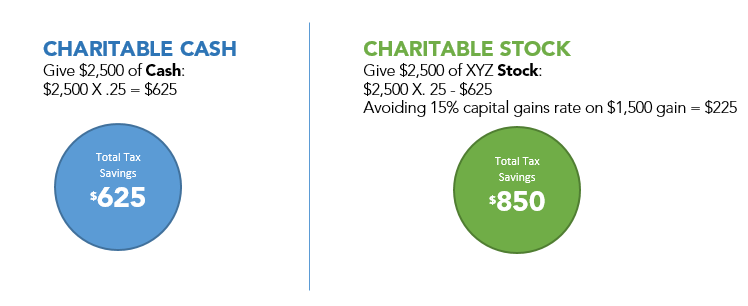

3) Donate appreciated investments. Consider donating a stock or mutual fund from a non-retirement investment account that has gone up substantially since you bought it. By donating the stock directly, you avoid paying taxes on the investment gain and you get to deduct the full value of the stock (two for one!). Here’s an example:

You buy 100 shares of XYZ stock for $10/share. Your total investment is $1,000. After a few years, XYZ stock is now worth $25/share. This means your 100 shares are now worth $2,500 and you have a long-term capital gain of $1,500. For this example, you are in the 25% Federal tax bracket.

4) Donate your Required Minimum Distribution (RMD). This strategy is technically called a “Qualified Charitable Distribution” or QCD for short. You are required to take a minimum distribution if you have an IRA or 401k once you turn 70.5. This is part of the deal you struck with the government when you started contributing to your traditional IRA or 401k (don’t forget they allowed you to avoid taxes on your contributions and to have them grow tax-deferred).

If you do not need your RMD to pay your living expenses and you have charitable intentions, you may want to consider directly donating your RMD to the charity of your choice. You cannot deduct this direct contribution on your tax return but the amount you contribute isn’t added to your taxable income for the year either, which often is better, especially if you have other income or deductions that are based on your Adjusted Gross Income (AGI).

Lastly, if none one of the above options appeals to you consider donating your time to help others in need. Giving back to your community can be incredibly rewarding and there is no shortage of worthwhile causes that could use a helping hand. Have a wonderful Thanksgiving!

Steven Elwell, CFP®, Vice President