What is the main difference between a Roth IRA and a Traditional IRA?

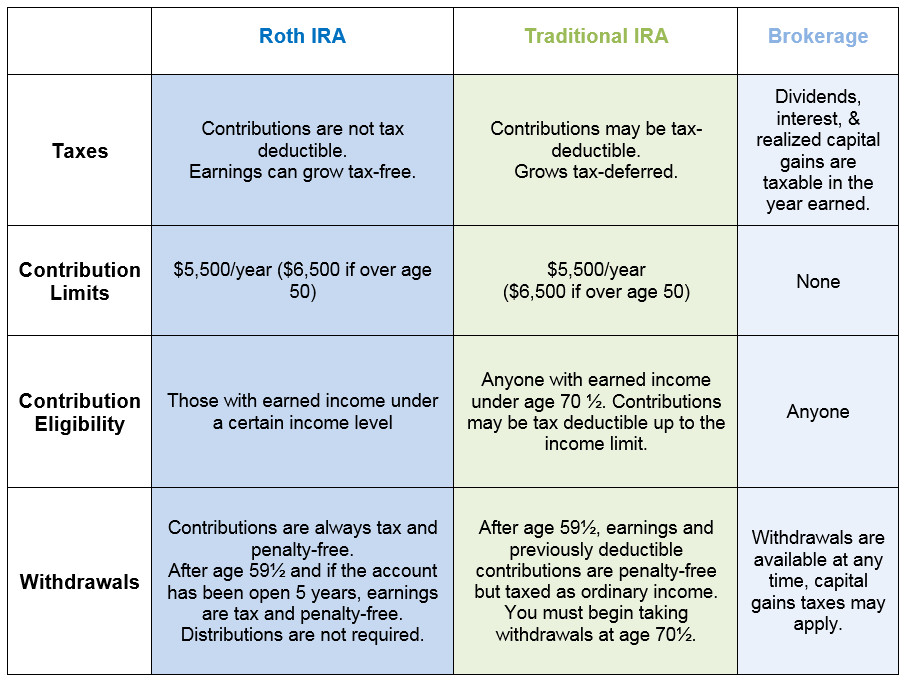

In a Traditional IRA, contributions can be tax deductible and growth is tax-deferred. Tax is paid upon withdrawal in retirement. Roth IRA contributions are not tax-deductible. Qualified Roth IRA withdrawals and growth are tax-free.

How do I decide which to choose?

Choosing between the two types depends on your income tax bracket now versus the future. Since there is no way to tell the future, you will need to come up with an estimate for what your tax bracket will be in the future. This also depends on what your specific goals are for future saving.

How can I estimate my retirement tax bracket?

You can begin by looking at your current tax return and eliminating things like your wages since you will not be working anymore and adding things like Social Security or a pension benefit. There are even some helpful online calculators where you can input what you think these numbers will be and it will tell you what tax bracket you will be in. You can also ask your CERTIFIED FINANCIAL PLANNER™ professional to help you with this.

Are there any tax benefits to using a brokerage account to save for retirement?

Yes, it allows you to take withdrawals at any time. This is important if you plan to retire before age 59 ½. These withdrawals will be subject to capital gains tax if the investment has done well, this tax rate is lower and more preferential than your marginal tax rate. If the investment has done poorly and there is a loss, you can deduct this up to an annual limit and you can carry forward the remaining loss to deduct next year.

What kind of investments can I use in each account?

You can invest in stocks, bonds, mutual funds, ETF’s, etc. The investments that you choose to place in these accounts are completely up to you.

Which account may be most advantageous for non-retirement savings goals?

A brokerage, this type of account will allow you to invest savings without the regulations determining when you can take withdrawals from it. A Roth IRA would also give you this benefit if you were looking to only withdraw your contributions.

What is the difference between these accounts and my 401k or pension?

These accounts are offered at most financial institutions, set up by you, and directed by you. Your 401k or pension is offered strictly through your employer and is generally directed by them. Your 401k may have limited investment options, unlike an IRA or brokerage account. Your 401k also has different contribution limits per year.

What yearly tax filing paperwork should I expect from each of these accounts?

Roth/Traditional IRA – Form 5498 – IRA contribution information, this form details your contributions and serves as a method of proof of your contribution amount for that year. Form 1099R – Distributions from pensions, annuities, retirement, this form would detail any amount that you distributed from an IRA. Form 5329 – Additional taxes on qualified plans, this form would detail the penalty you owed if you took a withdrawal from your IRA before age 59 ½.

What are other common names for a brokerage account?

Taxable account, investment account, etc.

Alanna Conciardo

Financial Planning Associate