If you were to ask yourself what you think the greatest risk in retirement was, what would you say?

One of the first subjects that might come to mind would be the risk of your retirement investments losing value. You aren’t alone!

According to a recent study done by the Center for Retirement Research at Boston College1, the greatest fear that most pre-retirees collectively have is market risk. Why? Because the market can be turbulent at times and that can spark fear — fear that seems to be more important than anything else. The same study found that most pre-retirees ranked their retirement fears from greatest to least as indicated below:

-

-

- Market risk (investment loss)

- Longevity risk (outliving your nest egg)

- Health risk (unplanned health costs)

- Family risk (unplanned costs in relation to health of family members)

- Policy risk (Social security benefit cut)

-

Clearly, all of these risks are valid, but how should we rank these risks compared to what the empirical data suggests? In other words, does the data show us that market risk should be our biggest concern as retirees? If not, what should it be?

According to the study, while market risk was important to consider, the greatest risks to retirees is actually longevity and health risk. These risks mean you either outlive your next egg or you are subject to unexpected health costs in retirement (such as long term care costs).

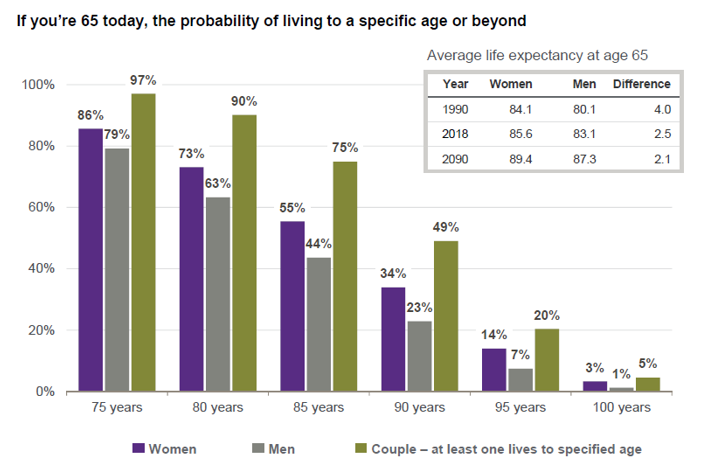

The table1 below shows the average life expectancy at age 65 and the graph indicates the probability of living longer than average. As you can see in the table, life expectancy is increasing. This is crucial to plan for because, as the graph states, nearly 50% of married couples will have at least one person that lives to 90 years old. Retirees might live longer than they expect and exhaust their savings in old age.

On top of all of this, the second biggest risk that retirees face is unexpected health costs. How can you plan for these unexpected costs? What’s the best strategy to prepare yourself for this? At Level Financial Advisors we help our clients by creating an estimate of nursing home and health care costs in your geographic area. Even if you are planning on moving out of state we can project costs there. We can calculate the average annual costs and build that into your plan, so that any unexpected costs are looked at and planned for.

This is why it’s important to remember that while the markets can be turbulent at times, it’s vital to have a financial plan. You do not know how long your life will be and it’s imperative to be prepared. Talk with your advisor and ask how age impacts your plan end. Having an advisor by your side can help you make these critical financial decisions to avoid outliving your savings.

Robert Decker

Financial Planning Associate

References:

1 How Accurate are Retirees’ Assessments of Their Retirement Risk?

2 Guide to Retirement by J.P.Morgan