You’ve done your part to set up a will and properly named your beneficiaries on key accounts. You’ve made your first important moves in the sometimes complicated process of estate planning. Suddenly, a tragic death in the family has you wondering “What will really happen with my assets when I pass?” Properly setting up your beneficiary designations is critical to ensuring your wishes are followed when you’re gone.

When a Parent Loses a Child

When a parent loses a child a “per stirpes” or “per capita” designation comes into play. These estate planning terms may seem like mere legal jargon, but they are crucial to ensuring that your assets pass to your heirs according to your wishes. The terms are added to a beneficiary titling to determine where the deceased child’s share of your inheritance will go.

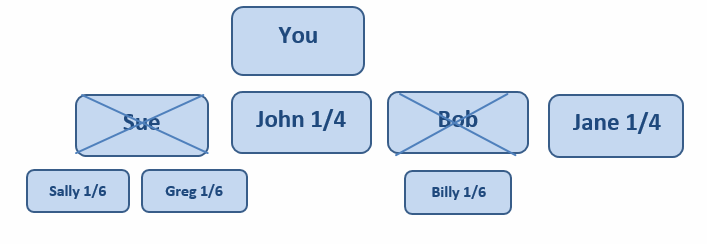

Per Stirpes – This designation means that if one of your children dies before you, their share will be split equally among their children (your grandchildren). For example, you have four children, Sue, John, Bob, and Jane. Sue and Bob pass away before you, Sue’s ¼ share of your inheritance will be divided equally among her children; leaving Sally and Greg each 1/8, and Bob’s ¼ share will be given full to Billy, his only son.

Per Capita – This designation means that if more than one of your children passes away before you, each of your grandchildren will receive an equal share of your inheritance. For example, if the assets were left to your four children per capita then Jane and John would each receive 1/4 of your inheritance and Sue and Bob’s children would each receive 1/6. This is because the three grandchildren are viewed as equal and are given their deceased parents total ½ share split three ways.

These designations can be used when naming beneficiaries on IRA’s, retirement accounts, life insurance policies, annuity contracts, etc. They can also be used to designate distribution methods in a valid will. It is important to review your beneficiary designations and your will regularly, especially when major life events take place such as the death of a child. It is also crucial to remember that any account that has a designated beneficiary does not flow through your will. So if you make a per stirpes designation in your will but not on your 401k account, the 401k will not follow the same distribution method.

Alanna Conciardo

Financial Planning Associate

Do you have a plan to for your beneficiaries? Contact us online to set up a free, one-on-one consultation to learn more today.