The Tax Cuts and Jobs Act (TCJA) passed in December 2017 is the largest overhaul to tax law in over 30 years. Tax experts and the IRS are still sorting out all of its implications and how to apply the new law, but it is clear the TCJA will have a significant impact on taxation of both individuals and businesses.

Due to the effective doubling of the standard deduction and the elimination of many popular itemized deductions, The TCJA has reduced tax incentives for making charitable donations for many people. Over my next few blogs I am going to explain the basics of three strategies that we are using much more often when discussing charitable gifting with our clients here at Level Financial Advisors. These strategies all have unique benefits over simply gifting cash.

Gifting of Long Term Appreciated Property

One of the first tax-saving strategies we consider when we find out a client is currently, or would like to start, giving to charity is gifting of long-term appreciated property. Sometimes that property is artwork, other times it is real estate, but most often we are discussing gifting highly-appreciated securities from a taxable investment account.

This strategy has several benefits with the first being that you are avoiding the recognition of long-term capital gains on the asset being gifted. One doesn’t have to look any further than 2008 to find unrealized gains of 200% or more on many equity mutual funds, ETFs, or individual stocks that were purchased at the depths of the Great Recession. If selling that appreciated security could find you paying long-term capital gains tax of 15% to 23.8%, gifting it to a charity may be a much more tax-efficient option.

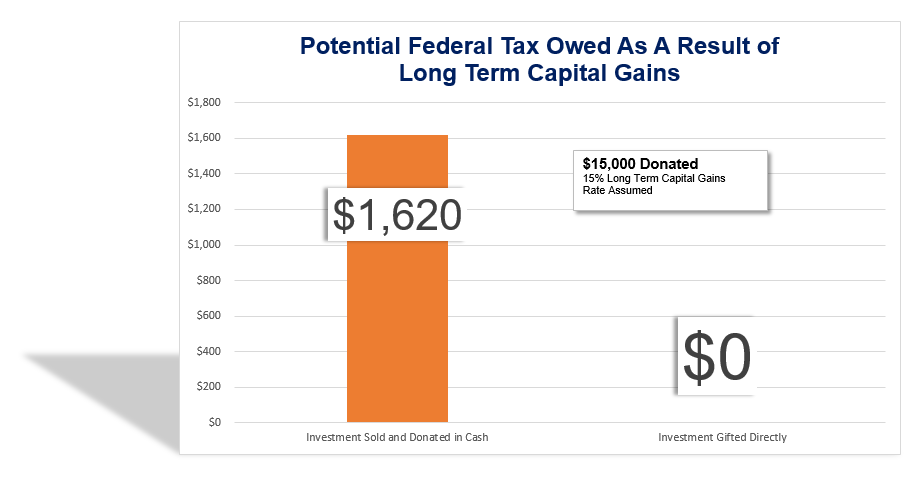

- Example: Robert and Susan want to gift $15,000 via check to their favorite charity. They plan to raise the cash by selling a US equity mutual fund they bought in March of 2009 for about $4,200. The fund is up 275% and is now worth $15,000! If they execute their strategy, they will recognize almost $11,000 of long-term capital gain and owe about $1,620 in federal tax at the 15% rate. The donation is tax deductible*

- If Robert and Susan were to gift the mutual fund directly to the charity instead of giving cash, they would avoid the recognition of the gain, still be able to deduct the full $15,000 on their tax return*, and the charity would immediately sell the mutual fund to get the cash value without having to pay any tax.

*The strategy outlined above is only valuable if the tax payer is still itemizing their deductions despite the recent tax law changes.

Tune in to my next blog to learn about a second charitable giving strategy that can help some people overcome the now higher itemized deductions hurdle. Follow us on Twitter, Facebook or LinkedIn to gain immediate access to this content when it is published.

Paul Coleman III, CFP®

Financial Advisor