We often hear some variation of the following question: “Some of my investments outperformed all the others; why don’t I put more of my money in the investments that did really well?”

For example, if we look at 2017, we see that large company growth stocks, especially those in the technology sector, performed exceptionally. So why wouldn’t we overweight our portfolio with these types of investments?

The Answer Is: if we could accurately predict this in advance and then concentrate all or more of our investments into the best performing investment type with a sufficient probability of success, we would. But we can’t. Lots of people try, but the historical evidence is clear. It can’t be done in an efficient and predictable manner. And here, with a minimum of investment jargon, is why:

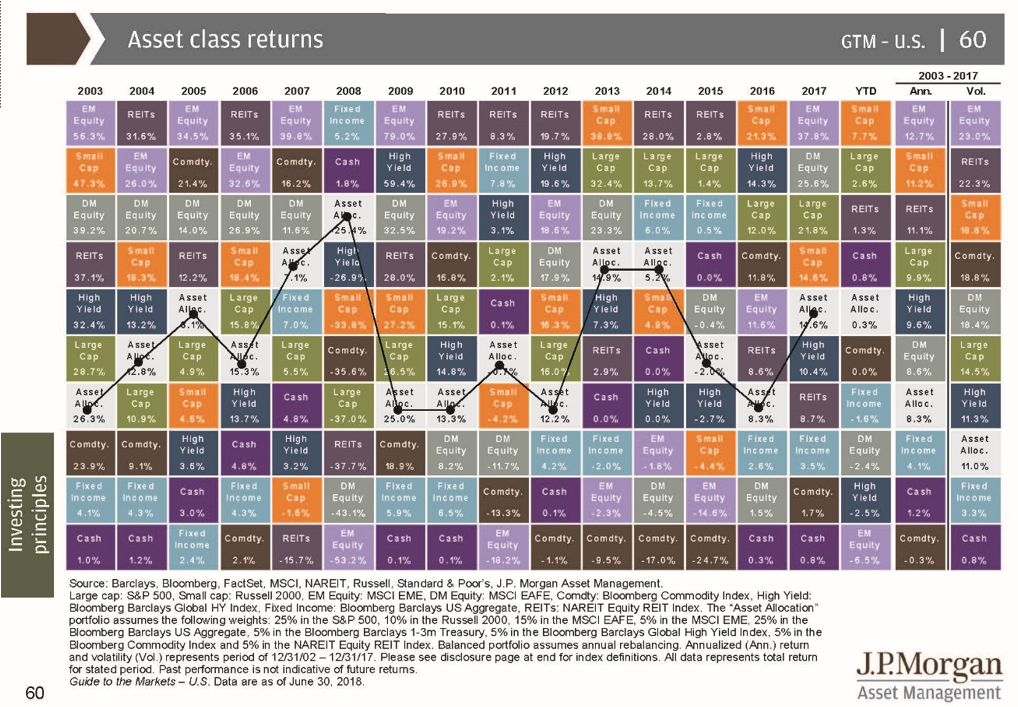

- The investment performance of each type of investment (or asset class), relative to all the other types, is purely random. Please see the history in the chart below. The winners and losers don’t follow a pattern.

- Even when we can foresee general economic trends, market gains and losses happen quickly. Missing these movements by only short periods of time results in dramatically lower returns.

- When we concentrate too much of our portfolio within one type of investment, the risk of catastrophic loss may increase to a level that is not tolerable.

Since we can’t determine the one place to concentrate our investments (often called “market timing”), with any probability of success, the only rational alternative is to diversify our money across all types of investments at all times and remain disciplined. Historical evidence tells what proportion to place in each type of investment to get an efficient return over time, given each investor’s unique risk tolerance and personal financial circumstances. This is the fundamental principal of modern portfolio theory and we are big believers.

But to use this technique, we must be comfortable seeing two things happen in the short term:

- There will always be investments in our portfolio that outperform the rest, creating temptation to chase the winners.

- From time to time there may be investments in our portfolio that temporarily outperform or underperform their historical averages. Returning to our 2017 example, the evidence tells us that large company value stocks outperform large company growth stocks over the long term and our models reflect that.But in 2017 the opposite happened! In the short term, we might be prone to once again chase the winners by modifying the model. However, historical evidence tells us that over time, the performance of both investment types will revert back to their averages and the better strategy is to remain disciplined.

Our investment management process is designed to deliver investment discipline and help you stay the course in all market conditions.

Winfred Jacob, CFP® ChFC

Senior Financial Advisor