The headlines have been dominated recently by the spread of the coronavirus and confirmation of over 80,000 global cases. The stock market has taken notice, and as of this writing, markets have declined approximately 11% from their recent highs last week. Meanwhile, the bond market has rallied strongly as investors flock to safer investments.

Undoubtedly, this outbreak has caused many people to become fearful about what might happen to the stock market and global economy going forward. We certainly are no experts in health care or medicine so we will save everyone from having to hear our opinion about how the coronavirus situation may play out.

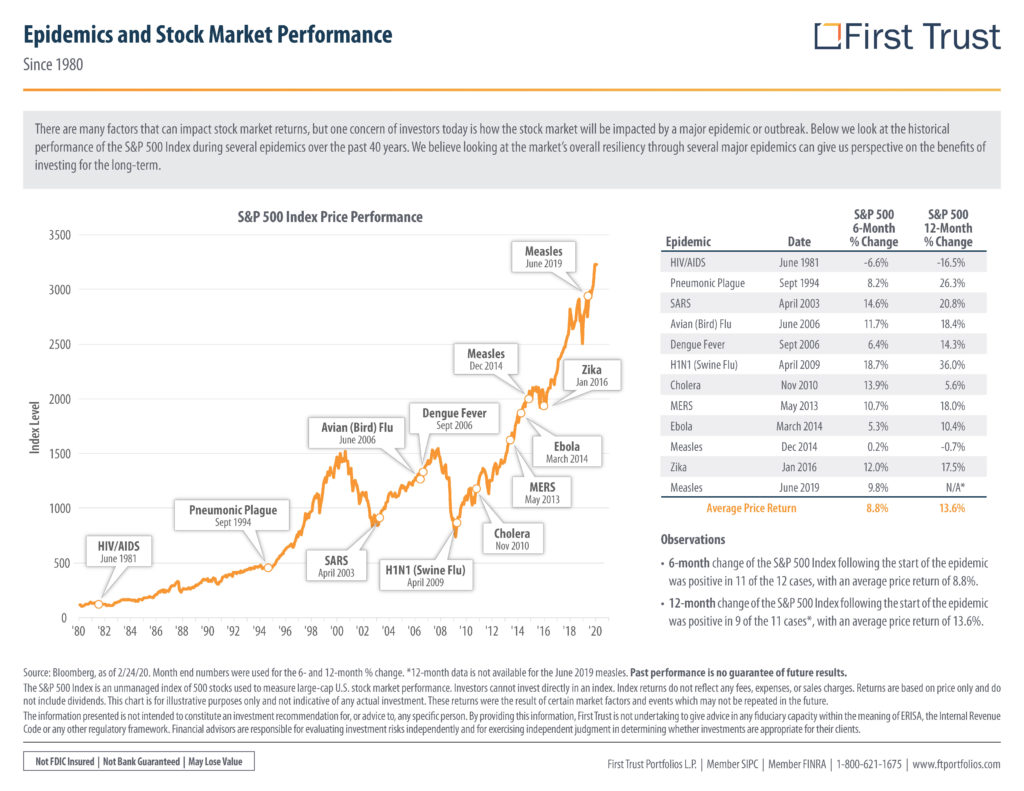

What we can do, however, is provide perspective on how past outbreaks have affected markets and what investors should keep in mind as the markets fluctuate. According to First Trust, during the last forty years there have been twelve major outbreaks. During those events, the average six-month S&P 500 percent change has been a positive 8.8%. The average twelve-month S&P 500 percent change has been a positive 13.6%.

Only the HIV/AIDS epidemic in the summer of 1981 had a negative six-month (-6.6%) and negative twelve-month (-16.5%) return for the S&P 500. Even then, in 1982, the S&P 500 returned a positive 14.76% for the year. If this epidemic is anything like those of the past, it will have a short-term effect on the markets.

But what if this time is different? There is no way for us, or anyone else, to know for sure how big of an effect it will have on the stock market, how long it will last, or how deep the decline may be. Fortunately, we have built our client portfolios to withstand stock market declines, even for those who are living off of their savings. Here are five major things to keep in mind when stocks go down:

1) Bonds provide a cushion, again – the stock market just had a quick 20% decline in the fourth quarter of 2018. The bond market rallied strongly then and has rallied strongly over the last few days as stocks have declined. This is the reason we own bonds, even when interest rates are low. They provide a safe place to get money while we wait for the stock market to recover, even if it took years. Most clients have anywhere between 25%-75% of their money in bonds just for this reason.

2) Dividends and interest still come in every month – cash will still be generated from interest payments on bonds as well as dividends on stocks. Just because prices of stocks go down doesn’t mean they stop paying dividends on profits. Yes, it is possible, if the economy went in to recession, that dividends could be cut, but it’s way too early for companies to be considering that. This ongoing influx of cash provides much of the money needed for those living off their portfolios. For those who aren’t living off their portfolio, this cash can be used to potentially take advantage of lower stock prices.

3) Rebalancing can take advantage of lower stock prices – rebalancing is widely considered a smart investment strategy, especially for those close to, or in retirement. This is the process of maintaining your target mix by selling things that are overweight and buying things that are underweight. Most people have heard that buying stocks low is a smart investment strategy, but few actually act on it themselves. If stock prices move lower, we will be taking advantage of lower prices by selling bonds, which would be overweight, and buying stocks while they are undervalued.

4) Lower stock prices are good for savers – those still saving for retirement are now able to buy stocks for 8% cheaper than last week. Normally, we would all celebrate buying something at a discount. The same goes for long term savers who are still making deposits to their accounts or have cash they have been waiting to invest. They will get to buy more shares of the same investment they already wanted to buy.

5) Lower stock prices are good for those doing Roth IRA conversions – many of you know that Roth IRA conversions are a major component of tax planning for those who have retired, but aren’t yet 72 years old. When stock prices are lower, we get to convert more shares to your Roth IRA, meaning when the stock market recovery takes place you get the benefit of that growth taking place in your tax-free Roth IRA.

We know it can be unnerving to watch the stock market decline dramatically and your portfolio value go down. We have been through many of these downturns together and have a plan for how to handle declines. As always, if you want to speak with your advisor about your specific situation and how this downturn affects you, please don’t hesitate to call us.

Steven Elwell, CFP®

Partner, Chief Investment Officer