Peter Lynch, the famous and very successful mutual fund manager, is quoted as saying “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.”

Recent market events have provided us with yet another example of why trying to “time” the investment markets just doesn’t work. At the close of business on June 23, 2016, the night before the Brexit vote results were released, the S&P 500 was up 4.52% for the year. Most investors probably went to bed that night confident that leaving their money in the markets was the right thing to do since the polls were leaning toward the U.K. remaining in the European Union. As we know now, the vote went in the opposite direction and Brexit heavily impacted the U.S. markets in the morning, sinking the S&P 500 by 3.76% almost instantly.

A market-timing investor may have decided to limit their losses and move their investments to cash on June 24 to avoid what was sure to be the start of the fall of the E.U. and months, or even years-long market decline. That same market-timing investor may have patted him or herself on the back the next trading day when the S&P 500 went down another 1.82%. In this example, this market timer is sitting on a 0.76% gain for the year while the rest of the market experienced a loss of over 1% and – some predicted – was about to embark on a downward spiral that would surely see equity losses of 10%, 20% and possibly even 30%.

When you let emotions (or hubris) take hold of you and you decide to pull out of the market during volatile times, the next question becomes, “When do you put your money back in?” The answer to that question is impossible to ascertain. No one can predict the future! Would you have put it back in after watching the S&P 500 climb 1.75% on June 28? How about the day after that when the S&P 500 gained another 1.73%? In just four trading days, the S&P 500 shot up 5.12% and gained another 3.24% in the following ten trading days.

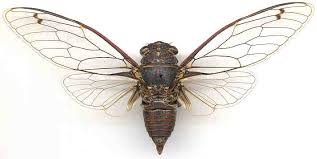

If all these numbers are making your head spin, just know this: you could have taken a three week Adirondack vacation in a cabin with no internet, rested peacefully every night to the sound of cicadas, and returned to find your S&P 500 fund up almost 2.8% from the day you left and 7.3% from the beginning of 2016. No stress, no worries, no market gambling; just gains.

Paul J. Coleman, III, CFP®

Read more about Paul Here