Election years can be fraught with uncertainty as developments surrounding the candidates, their platforms, and their predicted effects on the economy and markets dominate the news. But should you let this stream of political information influence how you and I manage your investment portfolio?

A lengthy history of empirical research suggests not.

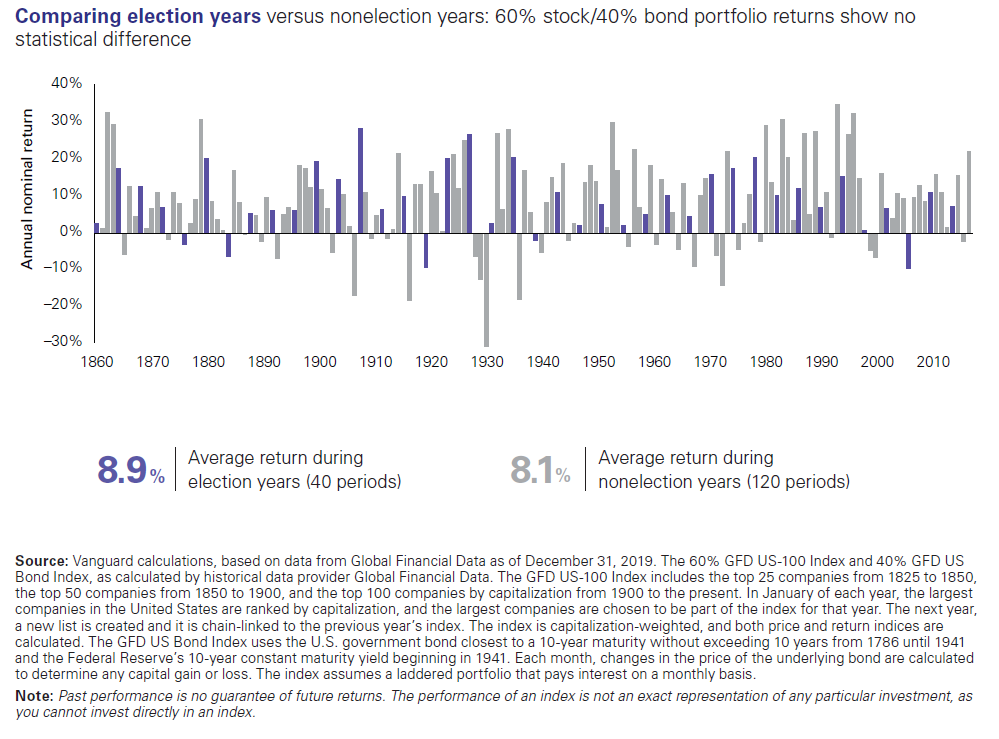

Elections matter, just not in all the ways you might think to an investor. Of course, they hold great importance in upholding the U.S. tradition of democratic, representative government. However, their impact on market returns has historically proven to be negligible, as shown in the chart below.

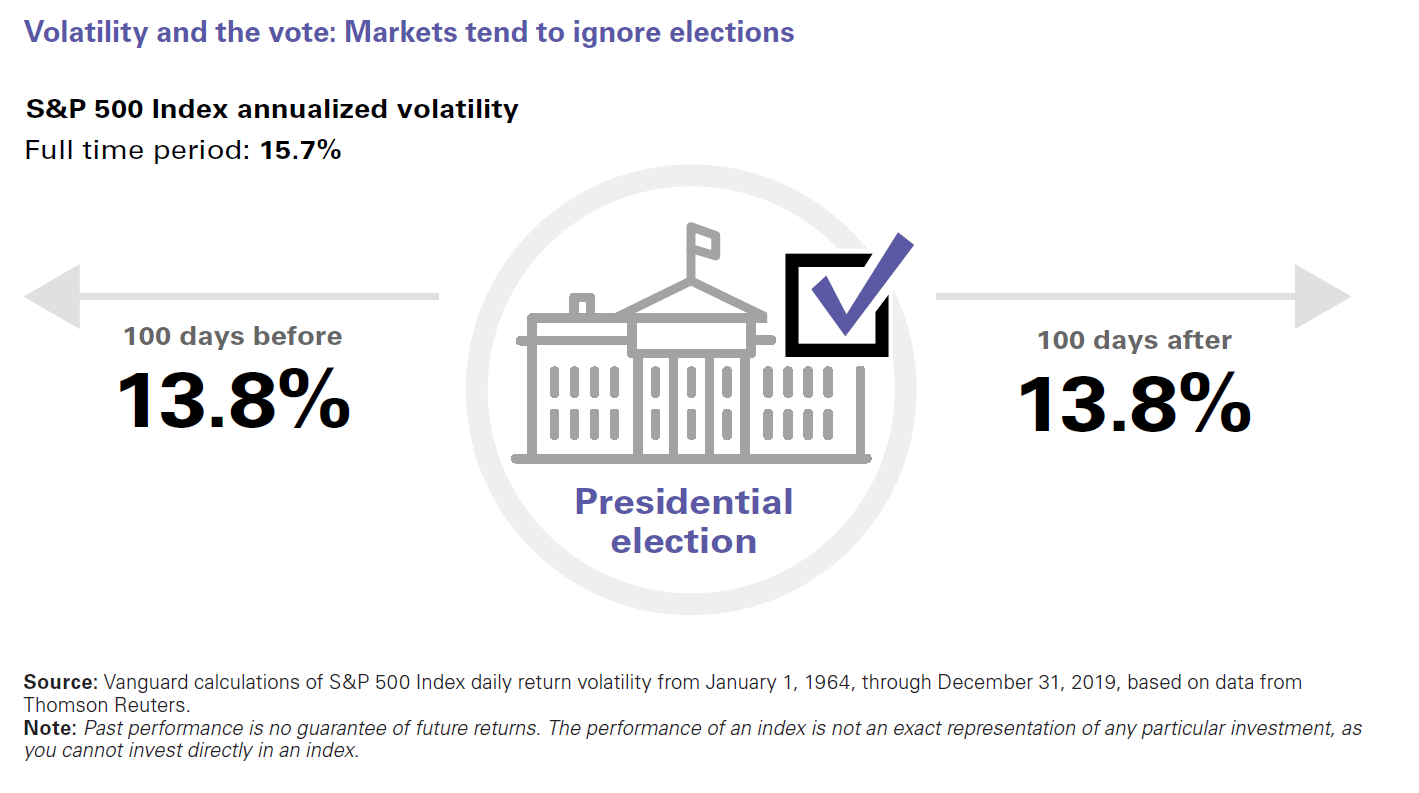

Given the horse race nature of political campaigns, you may think that in the months closest to an election, there is a noticeable uptick in volatility. Think again. In actuality, the opposite has been true. From January 1, 1964, to December 31, 2019, the Standard & Poor’s 500 Index’s annualized volatility was 13.8% in the 100 days both before and after a presidential election, which was lower than the 15.7% annualized volatility for the full time period.

The bottom line: Elections are another one of those events that generate lots of headlines but that should not sway you from following the financial plan we created. It’s understandable to have concerns about the election. But as far as your portfolio and the markets are concerned, history suggests it will be a nonissue.

Part of successful investing is understanding what you can control, and letting your emotions take a backseat to the financial plan you and your advisor put in place. By maintaining perspective, discipline, and a long-term outlook, you can sustain progress toward your financial goals, despite the short-run uncertainty that events such as elections can create.

Notes:

All investing is subject to risk, including possible loss of principal. Be aware that fluctuations in

the financial markets and other factors may cause declines in the value of your account. There

is no guarantee that any particular asset allocation or mix of funds will meet your investment

objectives or provide you with a given level of income.