Every parent wants to do what is best for their child and give them a chance to lead a successful life. For many this ideal includes a college education. This is why many parents sign for student loans without a second thought to what the implications might be. The Federal government offers loans to parents to help pay for their child’s college education, these loans are called Parent PLUS loans. Students have several loan options including Federal Perkins loans, Subsidized and Unsubsidized Stafford loans, and Graduate PLUS loans. Below I’ll compare the Parent PLUS loans to the Direct Subsidized and Unsubsidized Stafford loans a student can receive.

Interest Rates

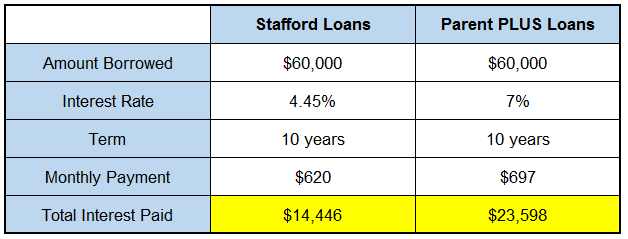

When using Federal student loans, students may be eligible for subsidized or unsubsidized loans. For loans disbursed between 7/1/2017 and 7/1/2018, undergraduate students will pay an interest rate of 4.45%. Conversely, parents under the PLUS loans program will pay 7% in interest. The difference in rates can mean large disparities in total interest charged over the life of the loan. Below is an example:

Difference in Total Interest Paid = $9,152

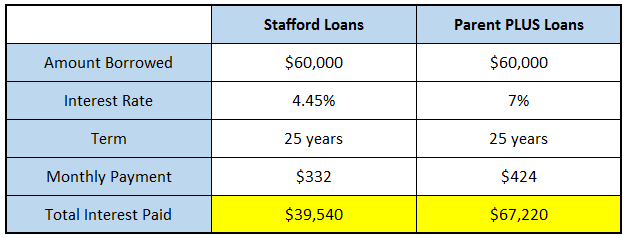

The numbers get even larger when you look at longer repayment terms:

Difference in Total Interest Paid = $27,680

Loan Repayment Options

With Federal Student loans there are several repayment plans to choose from. All direct subsidized, unsubsidized, and PLUS loans have standard, graduated, and extended repayment options. Income Based Repayment plans provide an additional option for situations requiring a different approach. Parents only have access to the Income-Contingent Payment Plan (IRC) after they consolidate their loans under a federal direct consolidation loan. Under an Income-Contingent Payment Plan (IRC) payments will be capped at 20% of the borrowers discretionary income. Income driven repayment plans for student borrowers like Pay-As-you Earn (PAYE) and Revised Pay-As-you Earn (REPAYE) plans generally cap payments at 10% of discretionary income.

Public Service Loan Forgiveness (PSLF)

This program forgives the remaining loan balance of public service employees after ten years of qualified payments. To qualify you must make payments under one of the allowed repayment plans. Parents can qualify for PSLF if they are on an Income-Contingent Payment Plan (IRC) and they are a public service employee. They will not qualify if they are not a public service employee but their child is. If you are not a public employee but there is a chance your child could be one it might be another reason to encourage your child to take out the loan instead of doing this yourself.

Your Financial Situation

Be careful when promising your child you can pay for their college education without considering your own situation.

- Are you on track for retirement?

- Are you accumulating debt rather than paying it down?

- How might monthly loan payments affect your lifestyle?

It sounds nice to say you are paying for your child’s college education, but it might not be so pleasant if your child has to take care of you financially in the future as a result. Your own financial health and retirement should be your number one priority. Keep in mind that if you run out of funds in old age, your only choices are to rely on fixed sources of income like Social Security, or generous family members, and Medicaid.

College increases your child’s future earning potential so it is not unreasonable to expect their future earnings to pay back loans debt. Loans in your child’s name do not mean you cannot help them make the payments if they are not able, but it would not be your legal obligation to do so. Before taking out any loans, consider your capacity to pay them back and carefully consider all the ramifications before signing on the dotted line.

Elise Murphy, CFP®

Financial Advisor

Need assistance with your college loan questions? We can help. Reach us online here