Mathieu Pellerin, PhD

Senior Researcher and Vice President

Dimensional Fund Advisors:

Many retirement investors hold equity portfolios that track broad market indices, either

directly or through other investments such as target date funds. Despite their

widespread popularity, market portfolios may leave money on the table. Core equity

portfolios—low-cost, broadly diversified equity portfolios with a moderate emphasis on

the size, value, and profitability premiums—can provide higher expected returns while

controlling the risk of underperformance relative to the market.

In new Dimensional research, we examine the benefits of core equity investing for

retirement outcomes. The potential benefits can start building up in the accumulation

phase. Consider two investors who contribute to a retirement account from age 25 to 65

and follow a conventional target date glide path, in which assets are heavily invested in

equities at younger ages and converge to a 50/50 mix of stocks and bonds by age 65.

The equity portion is invested either in a core portfolio or the broad market without any

emphasis on the premiums. Our results, summarized below, show that an investor in the

core portfolio will typically reach 65 with 15%–20% more assets than an investor in the

plain market portfolio.

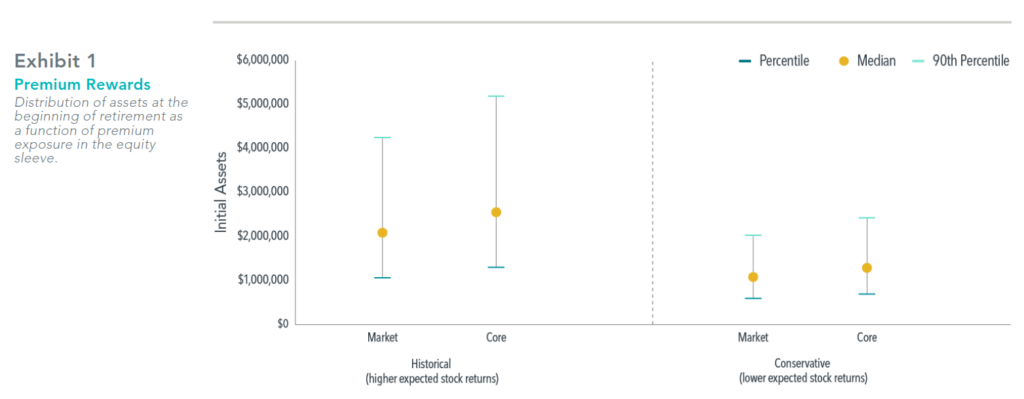

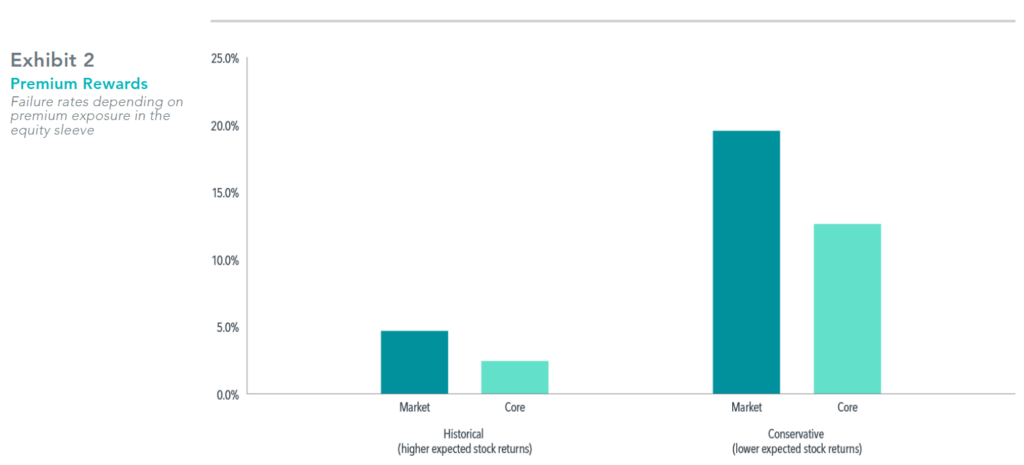

The observed benefits of core equity investing continue into retirement. Going back to

our example, let’s assume that both investors retire with a 50/50 split of stocks and bonds

and spend a fixed amount every year. If future stock returns look like past returns, the

probability of failure with either portfolio is low (see Exhibit 1), but the core portfolio still

does better—and, as we show in the paper, also results in a higher average bequest. If

future stock returns are lower than in the past, failure rates increase across the board, but

so does the potential benefit of core equity, which reduces the average failure rate from

20% to 13%. Here, too, the cost of tracking a market index appears steep; the chance of

running out of assets early jumps by 7 percentage points—nearly 54%.

Of course, these benefits come at the cost of tracking error relative to the market,

something that market indexing avoids by definition. However, our results show that,

when it comes to avoiding tracking error, the cure may be worse than the disease. The

study finds that market indexing results in initial retirement assets that are 15% lower on

average relative to the core approach. Would you give up an expected 15% of your

retirement assets to avoid all tracking error?

Retirement investing involves long investment horizons, which help improve the

reliability of capturing the premiums and magnify the effect of higher expected returns.

This makes core equity investing an attractive, practical alternative to market indexing—

one that can put retirement investors in a stronger position to reach their goals.

See attached for important sources and disclosures.