Higher-income individuals often must juggle a complex and unique set of financial variables in retirement if they hope to be as efficient as possible with their accumulated wealth. Many of the variables are tax-related and interrelated, and a change to one may affect the others.

Being proactive and forward-looking can help you uncover potential financial opportunities. Adopting a holistic view of your entire retirement will pay big dividends in tax efficiencies that can stretch your retirement nest egg.

Let’s focus on one specific variable: the Medicare premium surcharge, also known as the income-related monthly adjustment amount (IRMAA).

IRMAA and Your Taxes

Now, you might be thinking: Wait, what do Medicare premiums have to do with retirement tax planning?

At the risk of oversimplifying, here’s a quick summary. (More information can be found on Medicare.gov.)

- Medicare is our system of retiree health coverage. It charges each beneficiary a base premium for Part B (doctor visits) and Part D (prescription drugs).

- While most retirees pay just the base amounts, higher-income retirees pay more via a Medicare surcharge. It’s important to note that the extra charge provides no extra benefits to the retiree.

And here’s the tax connection:

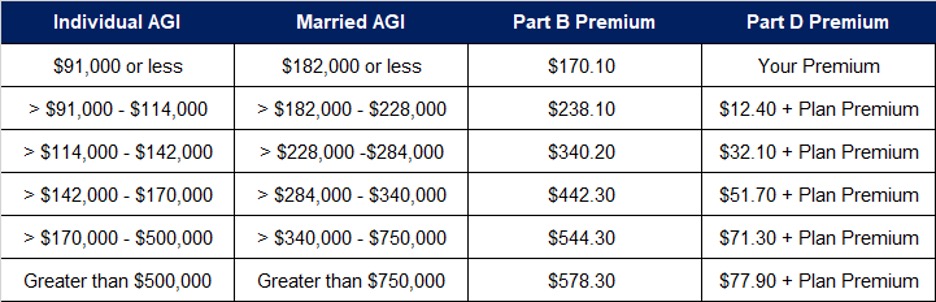

- The actual amount of the surcharge is organized into tiers and is based on your tax filing status and your modified adjusted gross income (MAGI). This is an important tax calculation, but you won’t find it on any line of your tax return. It also requires some additional number-crunching. While considerably more complicated, for many retirees the surcharge amount can be described largely as your adjusted gross income (AGI) with tax-free municipal bond interest added in.

- The tier you land in will dictate the surcharge that’s added to your base Medicare premium. There’s a separate surcharge for Medicare Part B and Medicare Part D. A handy reference table of the tiers is included below.

- The surcharge is set annually for the entire year and is based upon your MAGI from two tax years prior, as reported by the IRS. (For example, your 2022 IRMAA is determined by your 2020 tax return.) You may appeal the surcharge, but only if you experience a life-changing event, such as marriage, the loss of a job, or the death of a spouse.

- For a married couple, the surcharge for each tier is applied to both spouses on a cliff basis. Crossing the line into the next tier, even by one dollar, earns you the entire surcharge for the next 12 months. Clearly, the surcharge is worth paying attention to, especially when applied to both spouses.

Helpful Strategies to Offset IRMAA

So, what planning strategies can be used to navigate effectively around the tiers and mitigate the damage?

Here are six:

- Avoid any cliffs. The starting point for navigating effectively is to proactively analyze your MAGI in relation to the tier boundaries. If you’re close to the edge of the next tier, you might look for ways to reduce your MAGI prior to year-end. But under certain circumstances, you might also find it advantageous to pull future taxable income forward.

- Plan for MAGI-free sources of liquidity. Having available liquid funds that don’t create MAGI can be very helpful in your navigation. During our working years, there’s a tendency to concentrate our wealth in accounts that are pre-tax, like 401(k)s and IRAs, to reduce current taxation. However, the concentration limits our tax-planning options in retirement. If you’re in your pre-retirement years, give some thought to intentionally diversifying your wealth across the different tax buckets. A Roth IRA/401k, HSA, and after-tax brokerage accounts may help provide the needed flexibility.

- Do a Roth conversion before age 72. The required minimum distributions (RMDs) from large pre-tax retirement account balances, combined with Social Security benefits, will drive up MAGI after age 72 and push retirees into higher tax brackets. One potential solution is to convert some of these accounts to tax-free Roth IRAs before age 72. A carefully planned and executed conversion strategy can be a very effective tax-planning tool beyond just its effect on IRMAA. However, caution is advised, as the conversion creates current taxable income, which by itself may have negative effects on the surcharge. While Roth conversions prior to age 72 may be the most impactful, using the strategy after 72 can also have benefits, under the right set of circumstances.

- Engage in charitable giving that’s strategic. For retirees with charitable intent, certain gifting strategies may also help with IRMAA. For individuals over age 70½, you might consider the use of a qualified charitable distribution (QCD). This technique allows you to distribute up to $100,000 annually from an IRA directly to a qualified charity and use the distribution to satisfy your RMD. The distribution will not be included in taxable income, which lowers your MAGI.

- Harvest tax losses. Where possible, systematically harvest investment losses in non-retirement accounts. This means selling investments that have lost value and replacing them with comparable investments. You then apply the investments sold at a loss against any realized gains to minimize your capital gains tax.

- Optimize your tax location. This strategy intentionally “locates” the investments with the highest potential for gains within the most efficient tax buckets (Roth and after-tax accounts). Over time, the highest growth occurs in the non-IRA assets, also reducing taxable RMDs.

A Proactive Approach Will Always Win Out

Clearly, navigating IRMAA involves some heavy lifting. Still, if you’re a tax and finance do-it-yourself kind of person, you may enjoy the challenge. If not, use the information presented here as a starting point in selecting an advisor to help you.

While not easy, forward-looking financial planning delivers undeniable and measurable benefits. And the more proactive you become, the greater your opportunities to create retirement value and security.

We May Not Know the Future, But We Can Plan for It

There’s no crystal ball to tell us what federal tax brackets will look like decades or even years from now. But we can make some educated guesses based on what we know right now, and plan accordingly.

At Level, when we bring you on as a new client, we use sophisticated modeling software to create a long-term projection of your tax rates for the rest of your life based on all currently known variables. We know that our projections will never be 100% accurate; there can be a lot of surprises and unexpected events during a 10-, 20-, or even 30-year retirement. That’s why we stay committed and help you with any needed adjustments, especially if your financial outlook changes. We continually optimize every client’s unique financial picture in real time.

Want someone who can help you work through all the elements of a proactive retirement plan?

Talk to a trusted financial advisor before making any decisions. Feel free to reach out to us with any questions you may have or to discuss your retirement goals and concerns. Click here to set up a free consultation or call 716-634-6113.

About Level Financial Advisors

Since 1979, Level has helped countless individuals and families in the greater Buffalo area retire with dignity, achieve their financial goals, manage their wealth, minimize taxes, and leave behind a legacy. And unlike other so-called financial “advisors,” our CERTIFIED FINANCIAL PLANNER™ professionals are fiduciaries in the truest sense. We aren’t compensated for the products we sell, and we don’t work on commission, so you can be confident our advice is in service of your goals—not our own bottom line.