The IRS will began accepting and processing 2022 tax year returns on Monday, January 29, 2024.

Charles Schwab has a personalized 1099 Dashboard that provides expected dates for your 1099- Composite. You can access this dashboard by logging into the Schwab Alliance Website. You will get an automatic prompt directing you to this dashboard, however you can also locate it under the Statements tab.

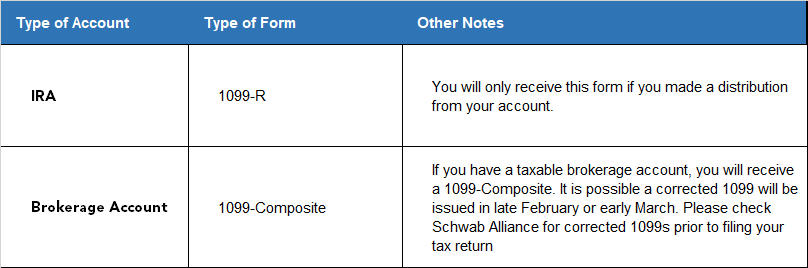

A corrected 1099 is generated when a mutual fund reallocates or reclassifies distributions. When this happens Charles Schwab is required to generate new 1099’s no matter how small the change might be.

Let your tax preparer know and make sure they have a copy of the corrected 1099.

Seek the guidance of your tax professional but you may have to file an amended tax return.

This is based on your mailing preferences with Charles Schwab and Level Financial Advisors.

If you signed up for E-delivery, then you will not get a physical statement in the mail. Schwab will send you an email letting you know when your tax documents are ready.

Please log into your Charles Schwab Account through the Schwab Alliance Website to see if any tax documents are available. If you can’t find the information you are looking for, please call us.

If you gifted any amount from your IRA DIRECTLY to charity, then you need to let your tax preparer know that it went directly from your IRA to the charity, as this is will not be reflected on your 1099-R. Level Financial Advisors will send out a separate confirmation letter for each IRA that used this specific charitable gifting strategy.

In order for the IRA distribution to have been made directly to charity, the check had to come from Schwab and be payable to the qualified charity of your choice. If the check was made payable to you, then it was a different gifting strategy and may be reflected elsewhere on your tax return.

You have until April 15, 2024 to make a 2023 Traditional IRA or Roth IRA contribution, but we urge you to contribute earlier. You can mail 2023 contribution checks made payable to Charles Schwab to our office any time prior to April 1st.

or any contributions between April 1st – April 15th, you have a few options that you can utilize to make a contribution:

If you want to establish a new account, let us know immediately.

MoneyLink– If you already have a moneylink set up, it will take 1-2 business days to send funds to your linked account. If you need to set up a new moneylink, it can take up to 10 business days; once it is set up, money will be sent in 1-2 business days.

Check by mail– This can take 7 to 10 business days to arrive at your home. Please allow ample time for this process. You can opt for overnight delivery for $8.50

Wire – Charles Schwab no longer charges for domestic wires done electronically. There is a $25 charge for wires done with a paper form.

If you have a brokerage account that holds municipal bonds, you may be able to exclude the income generated from those bonds on your tax return, depending on a few factors.