“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

― Charles Dickens

The above quote is the first sentence of the Charles Dickens masterpiece: A Tale of Two Cities. There may not be a better quote to describe the volatility of the stock market and the emotional toll on investors.

We know from studies of investor behavior that many tend to buy stocks during the spring of hope, and sell during the winter of despair. They buy high and sell low which results in poor long term returns. This is a natural, emotional response. When markets go down, the fight or flight part of our brain signals investors to run and seek safety.

Investors want to get out of stocks when they are down and get back in when they are moving up. Investors want all the good with no downside. Unfortunately, there is no system to enable investors to do this. In fact, investing is a field that may have more resources and brain power than any other and yet nobody has figured out how to consistently time the markets.

That is why the old adage “it’s time in the market, not market timing” that is the secret to investing success. The discomfort during sell offs is the price an investor needs to pay in order to earn the best long term returns.

In order to demonstrate the potential loss of returns that could have occurred during the last bear market from moving in and out of stocks, let’s consider a tale of two investors:

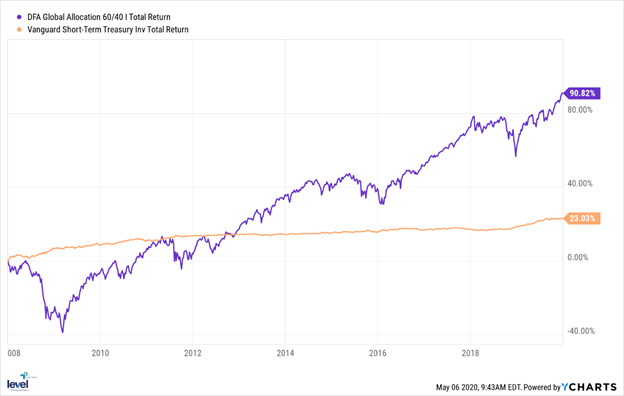

Both start the beginning of 2008 with $100,000 invested in a well diversified 60% stock and 40% bond mix, which will be represented by the DFA Global Allocation 60/40 mutual fund. This allocation is close to how Level Financial Advisors invests clients’ money (the purple line in the graph below).

By October 27th of 2008 the original $100,000 would be down 31.18% and worth $68,820 – a 1/3 loss that would test the will of most investors. This is where our two investors choose different paths.

Investor A does not sell, and on March 9th of 2009, the market hits its low point and the 60% stock portfolio is down 38.86% from its January 2008 value; the portfolio is now worth $61,140. You can imagine that everything in that investor’s brain is screaming to get out. But she does not, and by December 31, 2019 her portfolio has improved by 212% to $190,820 (the overall net return over the 12-year period ending December 2019 was 90.82%)

After losing one third of his wealth on October 27th 2008 Investor B decides to move to cash. He moves his portfolio to a short-term US Treasury mutual fund – arguably one of the safest investment choices at that time. This is not the lowest point of the crisis, so one could argue that the market timing was not bad.

Now comes the hard part – when to buy back in. One could argue that the cautious investor would not buy back in to stocks anytime near the bottom. So, let’s say they get back in around January 8, 2013. I chose this date because it is the date that the 60% stock portfolio has recovered to the point of value that the investor would have had if he was invested in the US Treasury fund since January of 2008 (this is where the purple line crosses the gold line in the chart below).

Investor B would have earned 9.70% while in cash during the period he was out of stocks. He then earns 60.93% between January 8, 2013 and December 31st, 2019 in his 60% stock portfolio, bringing his value to $121,495. This is less than if investor B was invested in the US treasury fund the whole time. The ending balance of holding the US Treasury fund the whole time would have been $123,030.

Over the 12-year period the dollar cost of getting in and out of the market, on a portfolio that started with $100,000, was $69,325 ($190,820 -$121,495).

If the investor had started with a $1,000,000 the moving in and out decision would have cost the investor potentially over $690,325.

In order to optimize investment returns, an investor should always try and think about these three things:

- The portion of your portfolio invested in stocks is a long term investment.

- Your protective instincts work against staying the course when markets are down.

- Long term success is about time in the market not timing the market.

Finally, at Level Financial Advisors we help clients build the portfolio that is suitable for them – one that keeps them on course and gives them the best probability of achieving the best possible investment outcomes. We accomplish this through developing a unique retirement plan, identifying the best investments, rebalancing the portfolio, and minimizing taxes through tax loss harvesting and tax location optimization.

Michael Angelucci, CFP®

Financial Advisor