The speed and magnitude of the decline in world stock markets so far this year may have you worried about the future. Is this the beginning of a giant bear market? Am I going to lose all of my money? Should I sell now and avoid further pain?

Investors often pose these questions at times like these. That’s when it pays to take a step back, breathe slowly, and relearn how stock markets work.

At this point, with the S&P 500 Index down 15% from its all-time high in May 2015, it is quite possible we are in a bear market, rather than a correction.

Corrections are defined as declines of 5% to 10% from which stocks recover fairly rapidly. We experienced a 10% correction last August and September, and recovered from it within a month.

Bear markets are generally defined as declines of 15% or more. Recoveries usually take a year or more. A very severe bear, like the 50% decline we experienced in 2008, can take up to four years. Even after that bear – the worst since 1929-32 – markets eventually climbed to new record highs.

Why do markets drop so dramatically? Because they are efficient and stock prices quickly reflect new, and usually unexpected, information. In this case the stunning decline in oil prices from over $140 a barrel to $28 a barrel, along with a larger-than-expected slowdown in the Chinese economy, have contributed to the 2016 decline.

Let’s emphasize what this means, courtesy of Weston Wellington of DFA Funds: “The world is an uncertain place. The role of securities markets is to reflect new developments – both positive and negative – in security prices as quickly as possible.”

What does that mean for us as investors? Wellington says that if you can accept “dramatic price fluctuations as a characteristic of liquid markets” then you have an advantage over other investors who are frightened over day-to-day swings in stock prices. In other words, you know that markets are working normally, you expect periods like this, and they don’t faze you.

Why aren’t you more upset? Because you know that every time a bear has occurred in the past the markets have recovered and gone on to higher highs. All you have to do is wait it out.

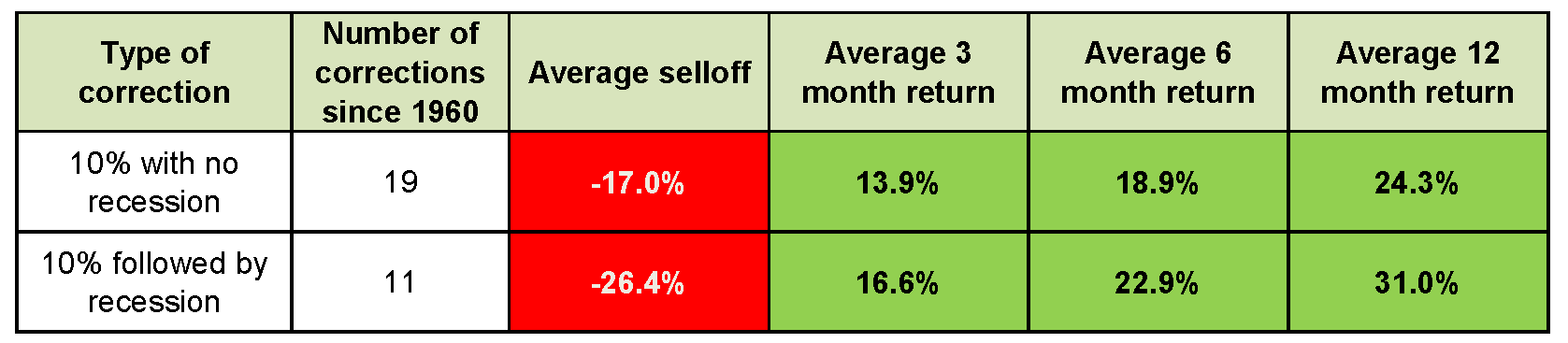

We know it is hard to imagine future gains when all you see are stock prices falling into the red, but here is a chart that shows what has happened after past stock market declines of 10% or more. It shows two types of declines: ones where the drop was not followed by an economic recession, and those that were followed by a recession:

Source: Deutsche Bank, Standard & Poor’s

As you can see, declines that are followed by recessions are bigger on average, but also have larger recoveries. In either case, most of the losses from a selloff have been recovered within a year. It should also be mentioned that bull markets following bear markets have lasted four to five years, on average.

So what should you do at this moment? Selling seems imprudent. You won’t have your money in the markets when the recovery – also as unpredictable as a selloff – starts taking hold. Sitting tight and using money from bonds and cash for any spending needs seems to be a more reasonable response. Those who have extra cash that they can commit to the markets for five years should consider buying. Although you may not catch the market’s lows, you are certain to be buying at lower levels than you could have a year ago, and probably at lower levels than you will see in a few years.

In the meantime, don’t hesitate to talk to us about your concerns. We often find that a review of your diversified portfolio can help alleviate the stress caused by stock market headlines. We are here to help you through each bear market so that you can come out stronger on the other side and with your financial plan intact.

Richard Schroeder CFP®, Jan. 20, 2016