With the Tax Cuts and Jobs Act ready for President Trump’s signature, many Americans are racing to understand a bevy of changes that will impact their 2018 tax return. After reviewing the new bill, we’ve put together a short list of important changes and developed a three-part series to assist in preparing for the upcoming change.

Part I of our series will focus on Tax Cut and Job Act highlights; the essentials of the new code.

Part II provides specific strategies people should consider doing now — in 2017 — to maximize tax efficiency.

Finally, Part III demonstrates a few hypothetical scenarios for tax filers, along with useful links and resources to help navigate the many questions and concerns that the tax change will present.

Individual Tax Rates and Brackets

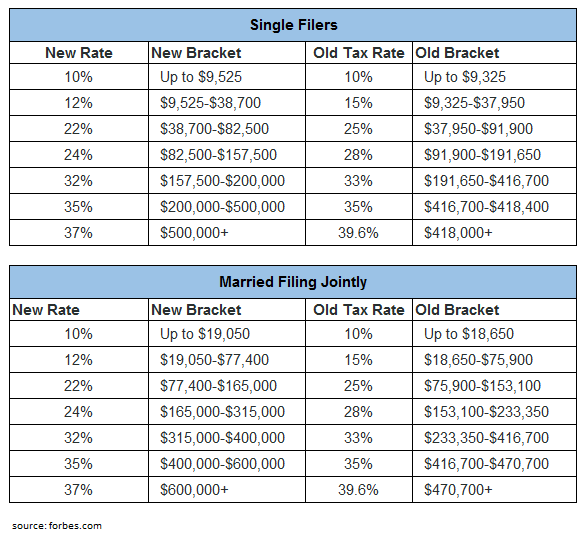

The most impactful change involves modification of existing tax brackets and rates. The tax act keeps the total number of tax brackets at seven, but changes thresholds and rates. The lowest tax bracket (10%) is unchanged, while existing rates are lowered. The 35% tax rate remains, but with much wider income thresholds. The highest tax bracket (39.6%) is lowered to 37%.

As in the past, tax brackets are adjusted for inflation each year, but the new law stipulates that adjustments are linked to a common consumer price index known as Chained-CPI, which should result in smaller adjustments each year.

The new tax rates “sunset” (expire) and return to the previous rates and thresholds after 2025. Congress could, as it has in the past, act to continue the rates before the sunset takes place.

Standard Deductions

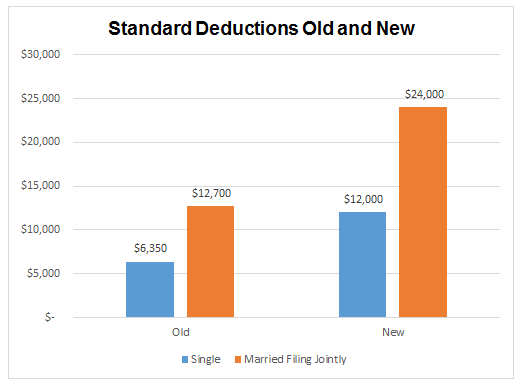

The standard deduction is dramatically increased in the new tax code. In addition, for anyone who is blind, or over the age of 65, the code continues to allow an additional standard deduction of $1,250 per person. The increase in these deductions is likely to cause many filers to no longer itemize. Experts estimate that the number of individuals itemizing deductions will drop from the current 30% to approximately 5% of all filers.

While the standard deduction is increased, the personal exemption is eliminated ($4,050 for individuals & $8,100 for married couples). Current law allows for the addition of the personal exemption to the standard deduction.

State and Local Tax Deductions

Filers will be able to deduct up to $10,000 of state income taxes and local property taxes, but the deduction is a combined cap. Moreover, there is no distinction made between single or married filers. In fact, for married, filing separately households, the cap is set at $5,000 (combined) per person.

Child Credit

A significant change to the code is the doubling of the child tax credit from $1,000 to $2,000 in 2018. The qualifying age of children under the age of 17 remains in place. For those with tax liabilities that would reach zero with the credit, $1,400 of the $2,000 is refundable, per child.

Further, the bill has increased the income thresholds for disqualifying for the credit from $75,000/$110,000 (single/married) to $200,000/$400,000.

The changes will likely make up for the loss of personal exemptions for most people. Like the new tax brackets, however, these credits and thresholds are scheduled to sunset after 2025.

Alternative Minimum Tax (AMT) Exemption Expands

The new law increases the AMT exemption from $55,400/$86,200 (single/married filing jointly) to $70,300/$109,400. The AMT exemption phase-out is also adjusted from $123,100/$164,100 to $500,000/$1 million for single/married filing jointly tax returns. Most people will no longer pay the AMT.

Mortgage Deductions

The new tax code puts a limit on the amount of mortgage interest you can deduct starting in 2018. Filers will only be able to deduct interest on the first $750,000 of principal for debt used to acquire, build or substantially improve a primary residence. The limitation applies to new mortgages taken out after December 15, 2017. Existing mortgages keep their deductibility, but only on the first $1 million of principal. If you refinance that existing mortgage, it too will retain the $1 million limit, but the law stipulates that no additional debt incurred can be added. Homebuyers with an existing contract in place by December 15 will have until April 1 to close on that purchase, in order to be grandfathered under old provisions.

In addition to these changes, home equity loan interest will no longer be deductible, including any loans made prior to 2018.

Deduction of Miscellaneous Items (Including Advisory Fees)

The new code eliminates all miscellaneous itemized deductions. This includes items that could previously be deducted after meeting a 2% threshold of adjusted gross income (AGI). In other words, fees for things like tax preparation, investment advisory fees, and home office expenses are no longer deductible starting in 2018.

It’s important to note, however, that since tax rates are lower and the income levels they apply to are expanded, the net change in tax burden for filers who lose these important deductions could be negligible or possibly improved. Each situation is different and filers should consult their financial advisor and tax preparer to estimate their changes for 2018.

Estate Tax Changes

The new code doubles the current estate and gift tax exemptions and is now $11.2 million for single filers and $22.4 million for married couples.

Corporate Tax Rate Reduction

Corporate tax rates drop from 35% to 21%. The rate is permanent and does not sunset.

For pass-through entities (S-corps, partnerships, and LLC’s), the new law creates a 20% deduction of pass through income for QBI (Qualified Business Income). In real terms this means that pass through businesses will be taxed on 80% of their business income, but reported on the individual’s personal tax return. The deduction is taken after AGI calculation and has a number of restrictions. Notably, the rule limits the QBI deduction to the lesser of 20% of business income or 50% of the total wages paid by the business to its employees.

Trusts and Estates

The new code reduces the number of tax brackets for trust and estates to four: 10%, 24%, 35% and 37%, reducing the top rate from 39.6%. The threshold to reach the top rate is $12,500.

Other Important Items

- Obamacare Individual Mandate Repealed, but not until 2019: Penalties will still apply in 2018 for individuals who do not have health insurance.

- Capital Gains Thresholds Remain Unchanged: Preferential capital gains and qualified dividends brackets will not change, and as a result, go by different thresholds than the new individual rates.

- Medical Expense Deduction Thresholds Reduced for 2017 and 2018: Medical expenses under current tax law are deductible after reaching 10% of adjusted gross income. The new code reduces that threshold to 7.5% and is retroactive to 2017 expenses. After 2018, the threshold returns to 10%.

- Alimony Payments No Longer Deductible: Payers are no longer able to deduct these expenses, and receivers are no longer required to report them as income. This provision does not go into place until 2019 and only affects agreements executed from that point forward.

- Business Entertainment Expense Elimination: Any business expenses for entertainment, amusement or recreation will no longer be deductible. Filers will continue to be able to deduct 50% of food and beverage expenses.

- Roth Characterizations of Prior Conversions Eliminated: The ability to “undo” a Roth conversion, called a “recharacterization” is no longer allowed starting in 2018.

- 529 plans, used today for college-related expenses are now expanded to be used for private elementary and secondary school costs. Up to $10,000 in distributions are allowed per year.

Read the text of the entire bill here for a complete detailed view of all changes to the tax code.

The new bill is arguably the most sweeping tax legislation since the 1980’s. It is likely to cause a fever pitch of activity over the next several weeks and months as filers, tax preparers, and financial advisors work to digest the new rules and potential strategies to follow. Most situations are unique and should involve a thoughtful analysis by a professional to understand the impacts.

Stay tuned tomorrow for Part II in our tax bill series: Important Year-End Strategies for Tax Filers. Our advisors will provide some potential actions to take in the final days of this year to maximize tax efficiency.