In a previous blog post (Converting Your Retirement Nest Egg to Income), I argued that higher income individuals must juggle a far more complex and unique set of variables in retirement than they faced in their working years, if they hope to be as efficient as possible with their accumulated wealth. Many of the variables are tax related and interrelated, in that a change to one may change the others.

While complicated, a holistic, forward-looking planning process pays big dividends in tax efficiencies that can stretch your retirement nest egg. This post will focus on one specific variable; the Medicare Premium Surcharge, called the Income Related Monthly Adjustment Amount or IRMAA.

Wait, what does Medicare premiums have to do with retirement tax planning? At the risk of oversimplifying, here is a quick summary explanation (for those interested, here’s a more detailed look from the IRS):

- Medicare is our system of retiree health coverage. It charges each beneficiary a base premium for Part B (doctor visits) and Part D (prescription drugs).

- While most retirees pay just the base amounts, higher income retirees pay more via a Medicare surcharge. It is important to note that the extra charge provides no extra benefits to the retiree.

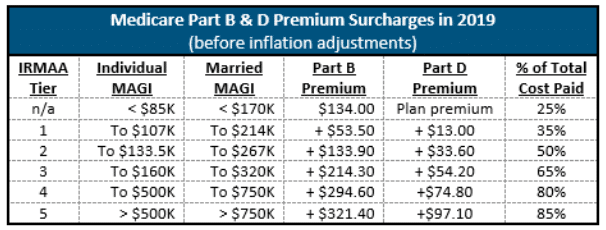

- Here is the tax connection: The actual amount of the surcharge is organized into tiers and is based upon your tax filing status and your MAGI (modified adjusted gross income). This is an important tax calculation, but you won’t find it on any line of your tax return and it requires some additional number crunching. While considerably more complicated, for many retirees it can be described largely as your Adjusted Gross Income (AGI) with tax free municipal bond interest added in.

- The tier you land in will dictate the surcharge that is added to your base Medicare premium. There is a separate surcharge for Medicare Part B and Medicare Part D. A handy reference table of the tiers follows.

- The surcharge is set annually for the entire year and is based upon your MAGI from two tax years prior as reported by the IRS (example; your 2019 IRMAA is determined by your 2017 tax return). You may appeal the surcharge, but only if you experience certain specific life events.

- The surcharge for each tier is applied to both you and your spouse on a cliff basis. Crossing the line into the next tier, even by one dollar, earns you the entire surcharge for the next twelve months.

Clearly, the surcharge is not insignificant (especially when applied to both spouses). So what planning strategies can be used to navigate effectively around the tiers and mitigate the damage?

Beware of the cliff(s): The starting point for navigating effectively is to proactively analyze your MAGI in relation to the tier boundaries. If you are close to the edge of the next tier, you might look for ways to reduce your MAGI prior to year-end. But under certain circumstances, you might also find it advantageous to pull future taxable income forward.

Plan for MAGI-free sources of liquidity: Having liquid funds available that do not create MAGI can be very helpful in your navigation. During our working years, there is a tendency to concentrate our wealth in accounts that are pretax like 401ks and IRAs to reduce current taxation. However, the concentration limits our tax planning options in retirement. If you are in your pre-retirement years, give some thought to intentionally diversifying your wealth across the different tax “buckets.” ROTH, HSA and after-tax brokerage accounts may help provide the needed flexibility.

ROTH conversions prior to age 70.5: The Required Minimum Distributions from large pre-tax retirement account balances will drive up MAGI after age 70.5 and push retirees into higher tiers. One potential solution is to convert some of these accounts to tax-free ROTH IRAs prior to age 70.5. A carefully planned and executed conversion strategy can be a very effective tax planning tool beyond just its effect upon IRMAA. However, caution is advised as the conversion creates current taxable income which by itself may have negative effects on the surcharge.

While ROTH conversions prior to age 70.5 may be the most impactful, the possibility exists to use the strategy after age 70.5 as well under the right set of circumstances.

Health Savings Accounts (HSAs): Younger individuals may have access to a high deductible health insurance arrangement and be eligible to contribute to an HSA. By maximizing the contribution, investing aggressively for the long term and paying out of pocket medical expenses from other sources during the working years, an astute individual may accumulate a sizeable account balance. The contributions are pretax, the growth is tax deferred and the distributions in retirement are tax (MAGI) free if used for qualified medical expenses. This can be quite an effective and versatile tool.

Charitable Giving: For retirees with charitable intent, certain gifting strategies may also help with IRMAA. For individuals over age 70.5, you might consider the use of a Qualified Charitable Distribution (QCD). This technique allows you to distribute up to $100,000 annually from an IRA directly to a qualified charity and use the distribution to satisfy your Required Minimum Distribution. The distribution will not be included in taxable income.

In conclusion: Clearly this process involves some heavy lifting. If you are a tax and finance do-it-yourself kind of person, you may enjoy the challenge. If not, use the information above as a starting point in selecting a partner to help you. While not easy, there is an undeniable and measurable benefit to forward-looking financial planning. The more proactive we become, the greater the opportunities to create retirement value and security.

Winfred Jacob, CFP®

Senior Financial Advisor