Let’s face it; consumers are growing tired of low interest rates on their checking and savings accounts. Bankrate.com recently estimated the national average annual percentage yield (APY) on money market accounts to be .11%. That’s just over one-tenth of one percent!

Millennials might not realize that banks paid rates in the double digits in the 1980’s. Baby boomers are often left feeling nostalgic for the good ol’ days of high returns for low risk savings.

Consumers who Google “high interest rates savings accounts” are inundated with a listing of banks they’ve probably never heard of before. Who are these banks and how do you know you can trust them?

Today, banks yielding the highest rates are often online banks – with no brick or mortar buildings or ATMs. These banks often provide streamlined electronic tools like web chat and responsive phone service centers to make up for their lack of physical locations near their customers.

How do you actually get money out of your online checking or savings account? Many banks offer features like mobile check deposit, debit cards, and online bill pay. They also offer transfers between their accounts and outside institutions with a few simple clicks.

The real advantage of these online banks is the 1%+ APY they are paying to account holders. The savings from overhead, fewer employees, and online account services are passed on to customers. Traditional banks are having a hard time competing, paying fractions lower to their customers.

Some of the biggest players in the online banking market include Ally, Synchrony, and Barclays. Most online banks are FDIC insured. The Federal Deposit Insurance Corporation – an independent agency created by Congress, insures up to $250,000 per depositor, per insured bank. This provides some piece of mind to anyone to who is nervous about opening an online account. (click on each bank to go to their web page for more information).

| Bank | Interest Rate | Minimum |

| Ally Bank | 1.00% | $1 |

| Synchrony Bank | 1.05% | $1 |

| Goldman Sachs | 1.05% | $1 |

| Incredible Bank | 1.11% | $2,500 |

| SFGI Direct | 1.06% | $1 |

| Barclay’s | 1.00% | $1 |

| CIT Bank | 0.95% | $100 |

**rates as of 8/30/2016

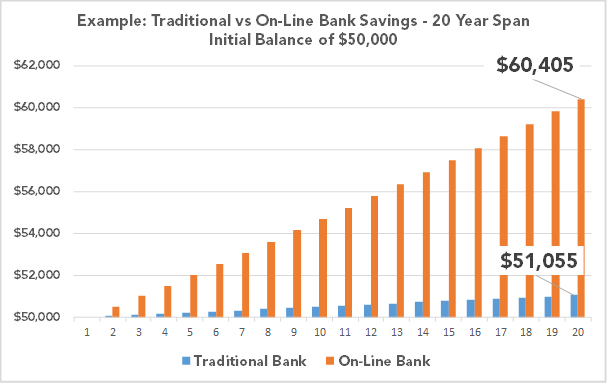

The math is simple. If a consumer has $50,000 in a savings account, paying .11% APY she will receive $55 in interest. The same account earning 1% will earn $500 in interest. Compounded over time the difference in savings is significant (illustrated in the chart below).

Elise Murphy, CFP®

August 31, 2016