One of the many ways we help people save money on taxes is by using a strategy called Tax Lot Optimization or TLO. Tax Lot Optimization is a strategy in which shares are sold in a thoughtful way to reduce or eliminate capital gains when trading in a non-retirement investment account. Investors can save hundreds, if not thousands, of dollars in the short term when this strategy is used.

To get more granular, Tax Lot Optimization is utilized when someone has multiple share lots of the same stock/fund purchased on different dates. For a retiree, this is a very common scenario. For example, if an investor bought shares of a S&P 500 index fund over a period of 30 years, they would have many different purchases dates as well as a different cost basis for each lot of shares. If these shares are held in a taxable account, the investor can choose how they would like to sell the shares. The way they determine how to sell these shares can have a major effect on their tax bill. Ultimately, there are a few options for this investor to select before the sale of shares. They can either use FIFO (First in First Out), LIFO (Last in First Out), Average Cost Method or Tax Lot Optimization.

Methods to Sell Shares

- FIFO method uses the first shares purchased and sells those first.

- LIFO method uses the last shares you purchased and sells those first.

- Average Cost Method is calculated by dividing the total amount of dollars invested by the number of shares owned. That amount is then your cost basis for each share owned.

- Tax Lot Optimization allows the investor to pick which specific lot they would like to sell.

Which Method is better?

While there are many differences between the methods listed above, many large firms default to using the FIFO method or the Average Cost Method. It makes the process fairly simple for the custodial firm.

The problem with using these methods is that you usually end up selling lots that have bigger capital gains than other lots, which may have no gain or smaller gains, that could have been sold instead. That is why Level Financial Advisors uses Tax Lot Optimization. We believe this is the most efficient way to save money on capital gains taxes when trading.

Why use Tax Lot Optimization?

Tax Lot Optimization is used because it allows our team to pick specific shares to sell that either produce a lower capital gain or even result in a tax loss. This is likely to reduce capital gains for that tax year. The case study below is an example of how much a client might save employing this strategy.

Case study

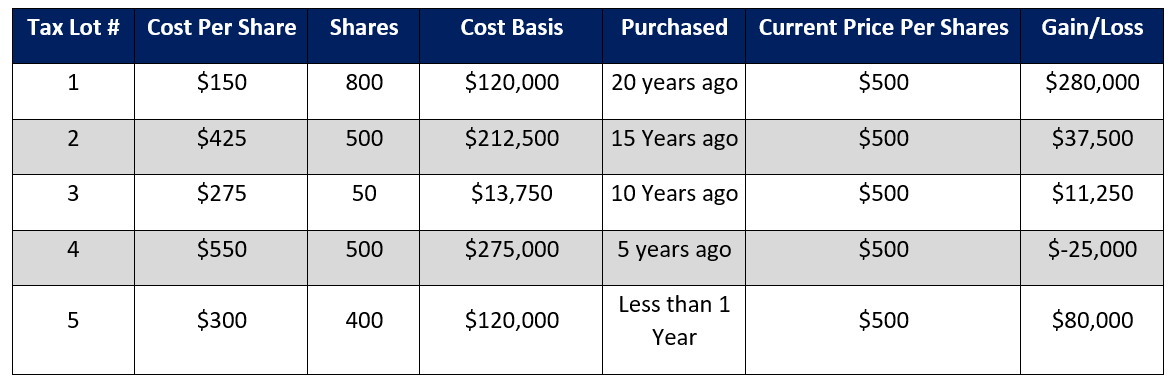

Below is an example of XYZ stock purchased in a brokerage account over many years. If an investor has a household income of $200,000, files jointly with their spouse, and wants to take a withdrawal of $50,000, what would the tax consequences be? How could we save this investor tax on the withdrawal?

As you can see, most of these shares are held for more than one year, which would mean that any gain upon selling those shares would be taxed at 15%. In Tax Lot 5, the shares are held for less than one year. This means that the gain will be taxed as ordinary income tax rates. For this investor that means a tax of 24%.

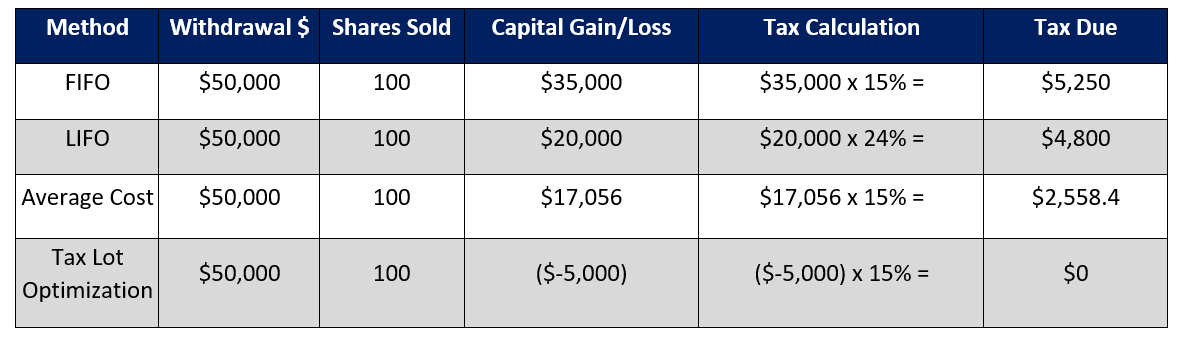

What would the tax ramifications be on the different methods to sell the stock?

As the case study shows, the Tax Lot Optimization method allowed an investor to withdrawal $50,000 without paying any tax. In fact, this investor can now use this loss to offset $5,000 in gains that year, or up to $3,000 of ordinary income if they don’t have any capital gains to offset. This is a huge bonus that can help an investor not only save money on capital gains, but reduce their income. An added benefit: the savings might prevent the investor from crossing any surcharge lines (like Medicare premiums or health insurance exchange subsidies). This demonstrates a stark difference between the FIFO method that cost the investor over $5,000 in capital gains tax.

Conclusion

While it is great that your hard earned dollars have created large gains over time, it’s important to know all the different moving parts when it comes to selling those investments. That is why Level Financial Advisors always looks at the entire financial picture when considering any taxable event like a withdrawal mentioned above. It’s critical to know how your taxable investments would be liquidated so you could potentially save thousands of dollars in tax when selling investments.

Robert Decker

Financial Planning Associate