Back in February, we anticipated writing an ongoing series of articles on the measurable value of forward-looking tax planning, a topic that we spend a lot of time thinking about here at Level Financial Advisors. We posted the first article, but then COVID 19 intervened in all of our lives and our attention turned to the more immediate topics resulting from the crisis.

This article brings us back to the tax planning theme and focuses on the use of tax favored retirement accounts. There are two distinct components to the planning function. First, we must make decisions about new contributions during our working years and then, just as importantly, make decisions about how to best distribute the funds from the accounts in the future. This article will focus on contributions and the next in the series will address distributions.

We must add a note of caution as some families are facing reduced incomes or economic uncertainty for the foreseeable future and the best strategy this year may be to conserve cash regardless of the tax opportunities. But while reduced income may make tax strategies less of a priority in 2020, the process of forward-looking planning will remain very significant over the course of a lifetime.

Tax favored retirement plan contributions

Congress has long held that investing for retirement is a good thing and incentivizes us to save personally by giving us tax benefits. The tax code allows us to make contributions up to a maximum amount each tax year to certain types of retirement accounts. Some types provide a tax benefit now and others allow us to reap the benefit in future years.

You may be eligible to fill up more than one type of retirement account each year. As a general rule, it is advisable to fill up each retirement account for which you are eligible to the maximum limit possible given the amount of liquid funds available. To do otherwise is to forgo a tax benefit and miss an opportunity that will increase your wealth over time.

What do you mean by “Tax Favored”?

Almost every type of retirement account available for voluntary contributions by individual tax payers is now available in two variations: One variation is pretax (or traditional) and one is ROTH.

A pretax retirement account contribution provides the tax payer with a tax benefit in the form of a deduction or a reduction in taxable income in the current tax year. The tax savings will be a function of your current tax bracket; both Federal and state. The investments within the account grow tax deferred until distributed and then the amount distributed each year is taxable as ordinary income.

A ROTH account contribution provides no tax deduction upfront, unless eligible for what is called the retirement saver’s credit; however, the investment growth and the distributions in retirement (or to heirs) is completely tax free, if we follow the distribution rules. This tax free compounding over time is a very powerful benefit. It is often fully appreciated if you calculate the ultimate tax savings and compound them by your investment growth rate over a lifetime.

Wait, don’t forget the HSA!

Some individuals may also take advantage of a Health Savings Account which could deliver the most impressive tax benefits of all if utilized optimally. In short, the HSA is an account available to individuals covered under a high deductible health insurance plan. You may contribute to this plan and use the accumulations to pay for out of pocket health costs not covered by the health insurance policy.

HSA contributions are pretax and the growth and all distributions used for health related expenses are also tax free when distributed. Seems like the best of all worlds, but it can be optimized even further. Many individuals use the accounts to accumulate and invest for retirement. They pay their current out of pocket health costs from current income and utilize the investment portfolios available within the HSA to compound the accumulations tax free for retirement over the longer term. In retirement, the account provides unique flexibilities to distribute funds tax free.

Planning Opportunities:

Again, effective retirement account tax planning has two distinct components; how to put money into the account today and how to distribute the account later. A tax payer may make pretax contributions now when in their highest earning years, but convert pretax accounts to ROTH IRAs at some future date. The conversion amount will be considered taxable income in the year converted. Good planning will allow us to intentionally convert during tax years with lower taxable income and lower marginal tax rates. Again, more on this in our upcoming blog post covering distributions.

The net difference over a lifetime associated with optimal tax planning can be quite significant. Tax planning software will help us estimate lifetime tax benefits. While individuals rightly spend much time and attention managing their portfolios in terms of asset allocation and investment selection, they often overlook the tax impact which can yield equal or even greater value over time.

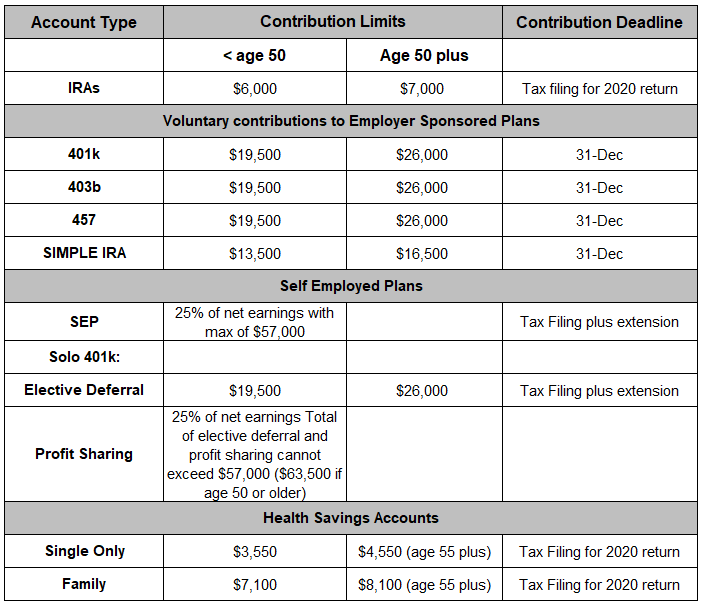

We have compiled a table below of the many tax favored retirement accounts that will allow voluntary contributions by an individual tax payer. Unfortunately, each one has different eligibility requirements as to income and employment issues.

Here are the variables to optimize within your unique financial circumstances:

- What is the maximum contribution amount possible and advisable?

For highly compensated individuals with sufficient liquidity, it may involve a combination of plans managed in just the right way. There may be additional and significant planning opportunities for individuals with more than one employer or someone who is both employed and self-employed.

- Pretax or ROTH?

Within each account, what is the optimal combination between Pretax and ROTH contributions? The variables to consider are eligibility, age, and current marginal tax bracket, versus your future tax brackets (or possibly the tax brackets of your heirs).

- What are the contribution deadlines?

Some forms of retirement account contributions must be made within the calendar year. Others may be made by tax filing time. Self-employed plans may have even more flexibility.

We recognize that the complexities of the tax code can make this planning seem overwhelming. At Level Financial Advisors, we have the tools and the experience to do the analysis and quantify the value of various tax planning scenarios for you. We strive to simplify the decision making and help you implement the right strategies given your unique circumstances and life goals.

Tax Favored Retirement Account Contribution Limits and Deadlines- 2020

Winfred Jacob, CFP®

Senior Financial Advisor