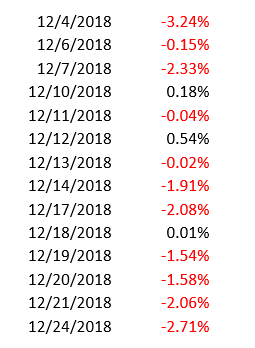

The stock market entered its own polar vortex in December 2018 and tested the discipline of even the most seasoned investors. December was brutal in both how much the stock market went down, but also in how relentless the decline was. There was basically no pause button in the three-week span from December 4th to December 24th. Take a look at the data on the S&P 500 for yourself:

On top of that, the pundits came out punching with claims of the economy entering a recession and how the stock market would continue to go down dramatically. The S&P 500 ended up losing 9.18% for the month**. It was a dark moment and people were at their wits’ end. Some investors inevitably bailed on their investment plans and sold all of their stocks. **according to YCharts

We have always maintained, and so has the evidence, that trying to time the stock market is a foolish game to play– and a game that might cost you a substantial amount of money if and when you get it wrong. We encouraged people to stick with their plan, despite the overwhelmingly negative outlook and constant onslaught of negative news. We even wrote a piece on 5 ways to take advantage of the recent decline on December 20th (kudos to you if you actually used any of the 5 strategies)!

What we didn’t know, and neither did anyone else, was how quickly the market would rebound. The S&P 500 just finished January 2019 up 8%. This is, yet again, another valuable lesson on how the stock market works. Millions of investors place trades that push prices up or down based on new information. Sometimes, there is a herd mentality that causes prices to become too depressed or too excited.

Our instincts tell us that whatever has recently happened will most likely continue to happen; there is even a term for it called recency bias. This works well for many things, but investing is not one of them. The dramatic reversal in stock prices is a result of the pendulum swinging too negative, recent economic reports showing the data to be better than expected, and recent earnings reports showing better than expected profits.

Charles Schwab’s top investment strategist, Liz Ann Sonders, says it best: “Better or worse matters more than good or bad.” What she means is many expectations are already built-in for economic and earnings reports. The market-moving information is not whether those reports are good or bad compared to the last report, but more importantly, whether they are better or worse than expectations.

So where does this leave us? 2019 is off to good start for those who stuck with their investment plan. There will always be the risk of a downturn for investors, but hopefully the events of the last two months will remind people that:

1). Trying to predict the short-term future is impossible.

2). The market can turn faster than you can imagine.

3). What has recently happened is no indication of what will happen next.

This will not be the last time the stock market throws a curveball, but the best investors will remember this moment. They will remember how bad it felt on December 24th, 2018 and how much better they felt on January 31st, 2019. And lastly, they will use that lesson to avoid investment mistakes when the next downturn comes.

Steven Elwell, CFP®

Partner, Chief Investment Officer