The stock market has continued to tumble as investors flee to safety over concerns about the impact on the economy from COVID-19. Rightfully so, there is an expectation of an economic slowdown as a result of people staying inside to try and limit the spread of the virus. Does this mean investors should expect stocks to continue to decline for months?

First, the stock market has already priced in a recession, that is why the market is down over 30% already. The stock market is a forward-looking machine and it always has been. This applies to recoveries as well, and we fully expect the market to recover before the economic data actually shows a recovery. This is why selling stocks and “waiting until things look better” is a bad investment strategy. By the time things look better, the market will already have started to recover.

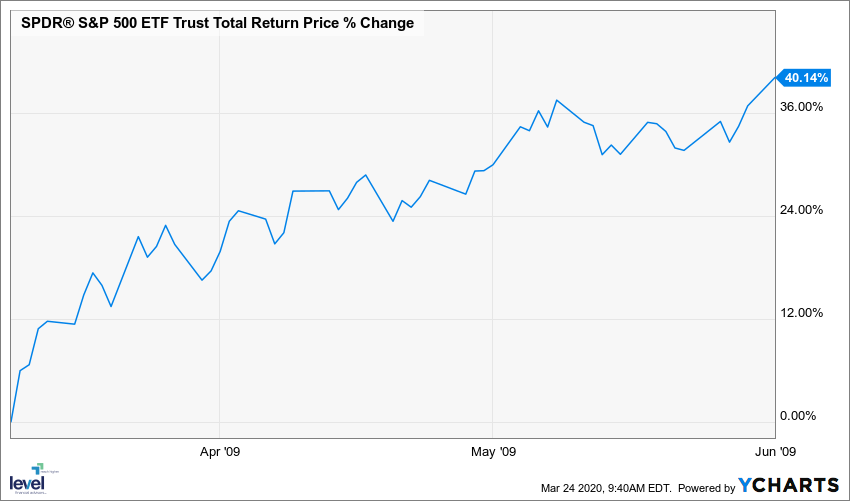

Case in point, this chart shows the recovery in the S&P 500 starting on March 9th, 2009:

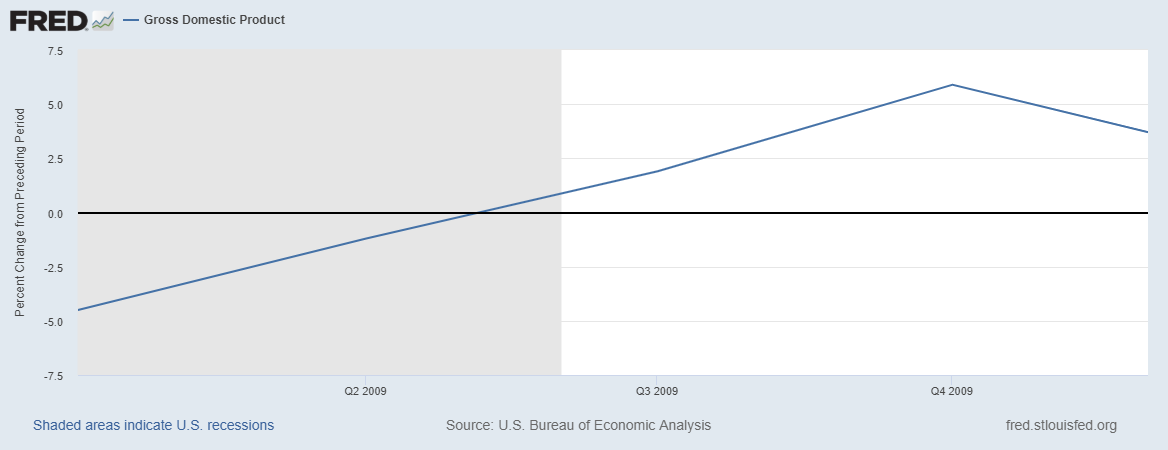

This is despite the recovery in economic data not starting until the 3rd quarter 2009:

Additionally, the Federal Reserve Board and Treasury Secretary Steven Mnuchin have been doing everything in their power to provide liquidity to the markets. Here is a brief list of things they have announced already:

- .50% surprise interest rate cut in an effort to stimulate the economy (March 3rd)

- 1.0% surprise interest rate cut, effectively taking interest rates back to zero (March 15th)

- $700 billion in quantitative easing, which is buying longer term bonds to drive interest rates lower (March 15th)

- TALF (Term Asset-Backed Securities Loan Facility) program to lend to investors to buy consumer related debt (March 23rd)

- Unlimited quantitative easing to further provide liquidity to bond markets (March 23rd)

- Created a facility to provide lending to highly-rated corporations (March 23rd)

- Created a facility to buy investment grade corporate debt and even qualified ETFs that invest in corporate debt (March 23rd)

- Attempting to create a program to lend to small and midsize businesses (March 23rd)

- Attempting to get authorization to buy longer-term municipal bonds (March 23rd)

- Changing current programs to include lending for high quality, short term debt issued by states and local governments (March 23rd)

- Changing current programs to include municipal variable rate demand notes and bank CDs to prevent runs on money market funds (March 23rd)

The Fed and Treasury Secretary have effectively thrown everything at the economy and bond market, including the kitchen sink. In fact, to stick with that analogy, they’ve even thrown the neighbor’s kitchen sink at it as well. This is all before Congress has officially passed legislation to help the consumer too, which we await details on.

Lastly, I’ll end with an interesting observation. It has long been said that lower stock prices = higher future expected returns. We have seen this hold true during the decline in the fourth quarter of 2018, early 2016, the 2008 crash, and previous downturns before it. We were encouraged to see Vanguard recently updated their 10-year, forward-looking expectations for US stock returns:

Expectations as of 12/31/19 = 4.4% annualized*

Expectations as of 3/12/20 = 6.8% annualized*

We agree with Vanguard that future expected growth is now higher than what it was just one month ago. Investors who own or buy stocks today are accepting the risk of the moment and thus deserve to be rewarded in the long run for taking on those risks. The only way to get those higher expected returns is to stick with your investment plan. We think this recent quote from Jake DeKinder of DFA sums up why it’s important to stick with your investment plan; “[T]hink of it like a roller coaster, the time you get hurt is when you get out of your seat.”

As always, if you want to speak with your advisor about your specific situation and how this downturn affects you, please don’t hesitate to call us.

Steven Elwell, CFP®

Partner, Chief Investment Officer

*these are Vanguard estimates; actual results may differ.