Financial advisors routinely advise American workers to save as much money as they can for retirement, preferably in a tax-deferred savings plan. Social Security will only fund about one-third of the average worker’s retirement income needs, and few workers these days are covered by old-fashioned pension plans. Just 10% of workers over age 22 have traditional pensions, found a recent Pew Charitable Trusts analysis.

Unfortunately, a new study by the U.S. Census Bureau says that only about one-third of workers are contributing to an employer-sponsored 401k plan or other tax-deferred savings plan.

Even worse, the research indicates only about 14% of employers offer any type of savings plan. Although large companies tend to offer plans, the many employees working for employers with 100 or fewer employees may have no plan available to them, the research found.

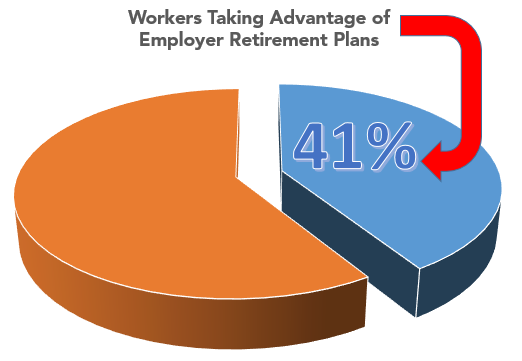

When it comes to employers that offer tax-deferred plans, only 41% of workers are taking advantage of them, the Census study found. It also found that some workers don’t sign up for plans because they don’t know they exist, or because they ignored confusing sign-up forms when they first got hired.

Some states have attempted to set up plans that employers must automatically enroll workers into, but the states have met with resistance from Congress and the financial services industry, which call the move “unfair competition.”

Don’t fall into the habit of ignoring your retirement needs. Ask your employer whether it offers a tax-deferred plan. Sign up and start contributing. You should aim to sock away from 10% to 15% of your gross salary every pay period. If you can’t start out saving that much, begin with a smaller amount and gradually increase your contributions over time.

If your employer offers to match a portion of your contribution, find out what percentage of your salary you must save in order to get the maximum match, and use that amount as your starting contribution. You can work up to 15% of salary from there.

Richard Schroeder CFP®

Chief Investment Officer