Earlier this year DeVere Group conducted an interesting survey of 752 investors who have over $1 million in investable assets.

Investable assets, such as stocks and bonds, are those which can be converted to cash relatively easily and they exclude physical assets like real estate. The survey asked these affluent investors what their biggest investing mistakes were before they started working with a financial professional.

Here is what they found:

Top 3 Results:

-

-

- Leaning too heavily on historic investment returns (38%)

- Not seeking professional financial advice (35%)

- Failure to adequately diversify investment portfolio (21%)

-

We have seen these same mistakes negatively impact many investors who are trying to reach their financial goals. It would not be difficult to argue that almost all investors have battled with one or more of these mistakes at some point in their lives. Let’s take a quick dive into each of the three results mentioned above to get a glimpse of how these errors could be a detriment to you.

Leaning too heavily on historic investment

Most of us have heard the saying, “past performance is no guarantee of future results.” Yet, many investors select their investments by looking at how a fund has performed and where it ranks historically. Interestingly enough, multiple academic studies have proven that this type of investment strategy doesn’t work.

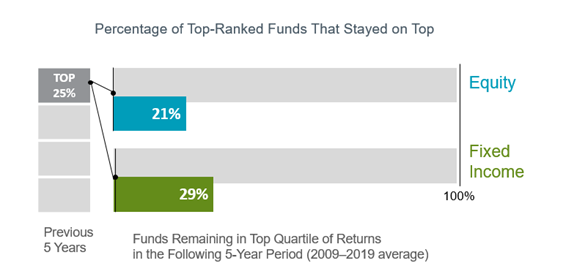

Dimensional Fund Advisors (DFA) studied funds that performed in the top 25% over the last 10 years. They found that only a small minority of funds that were top performers in the “previous 5 years” ended up being a top performer again over the “following 5 years.”

Only 21% of equity/stock funds and 29% of fixed income/bond funds that were top performers in the past five years remained top performers for the next five years. Selecting investment funds based purely off of past performance will likely result in disappointing performance and may result in “performance chasing.”

Not seeking professional financial advice

In today’s world, DIY projects have become a fun hobby for many when it comes to home improvement or other endeavors. These are areas where small imperfections might go unnoticed, and a lack of knowledge can be substituted by watching a quick video. In contrast, financial planning and investing have significant and exponential differences at the margins. When you are working with hundreds of thousands of dollars, or even millions, then small changes can have substantial impacts.

As seen from this study, doing it yourself may result in missed opportunities and mistakes. All of us have trouble seeing our own blind spots when it comes to our finances.

For example, how many individuals are spending the time to determine how to create a tax efficient portfolio? How many understand when to make Roth conversions, and how much to convert? Are they looking to “tax harvest” investment losses in a down market (like in spring 2020)? Very few people have the knowledge, or for that matter, the time, to get maximum efficiency from their personal finances.

Failure to adequately diversify investment portfolio

Diversification is one of the bigger buzzwords within the realm of the personal finance industry. Most people could give you a general definition of diversification. A diversified portfolio will include various securities that are exposed to different risks and, as a whole, will reduce the overall risk within a portfolio.

Mutual funds and ETFs can be used effectively to diversify a portfolio because they contain a “basket” of stocks/bonds, rather than just owning a single company’s stock. A well-constructed portfolio will take this process further by diversifying the types of investments – and I am not just referring to owning stocks and bonds.

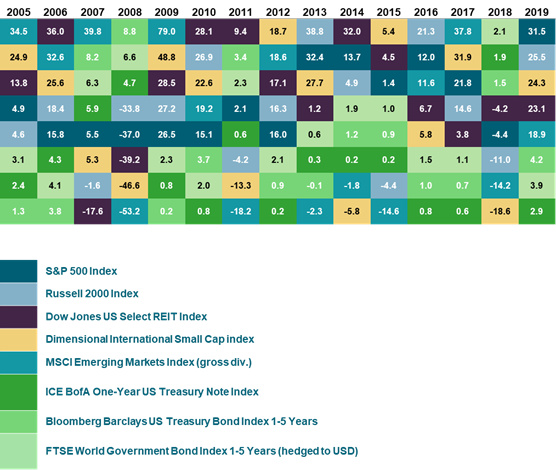

Since no one has a crystal ball that can be used to consistently time the market or pick the best stocks, it is imperative to expose your portfolio to all types of assets. Within each economic cycle, large cap and small cap stocks react differently and have varied success. A slow economy in the US could be an entirely different story in emerging markets and international economies.

The fact of the matter is you need to expose your portfolio to many types of assets to avoid missing out on gains elsewhere in the world and to protect against economic downturns. The following graphic was produced by DFA to illustrate just how varied annual returns are for different asset classes. The chart is sorted top to bottom in each year from best to worst performing for several major indices. If you aren’t adequately diversified, you may miss out on certain gains and subject yourself to greater risk.

James Smith

Financial Planning Associate

Source: