Throughout our working life we become accustomed to seeing chunks of our paycheck withheld for different types of taxes. Not many of us get a warm fuzzy feeling about contributing our share of payroll taxes to the government for Medicare and Social Security. Fortunately, the government gives you back the money in the form of monthly payments for the rest of your life and possibly your spouse’s life as well.

As you approach the age range when you can finally claim social security, between age 62 and 70, it becomes imperative you consider the best strategy for your situation. As you delay claiming your benefit, the government significantly increases your benefit each year. In fact, every year you delay after full retirement age, you receive a guaranteed 8% increase in your benefit (this stops after you reach age 70). Try finding a guaranteed 8% return anywhere else!

While there are many factors to consider when choosing the age that you will claim your social security benefit, let’s look at what the “break-even” age is for delaying your social security benefit. In other words, how long does it take for the larger benefits to be worth the wait? After all, if you wait till age 70, you will have missed out on 8 years of money, or 96 monthly payments. Is it even possible to make up that difference without living to be 100?

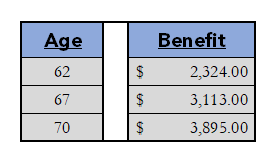

Let’s consider the fictitious case of Peter Johnson, who is age 62 and deciding when to take his social security. Since he was a high-earner throughout his career, Peter qualifies for the maximum social security benefits. The table below lists the maximum benefit for age 62, 67, and age 70 for the 2021 year.

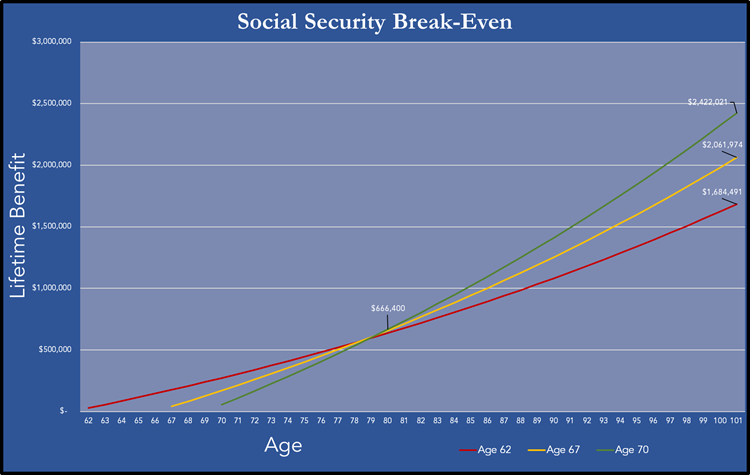

To calculate the break-even age, we will look at the total sum of benefits that Peter receives over his lifetime under three different scenarios. Scenario 1: Claims social security at age 62 (red), Scenario 2: Claims benefit at 67 (yellow), and Scenario 3: Claims benefit at 70 (green).

In creating the estimate of the lifetime benefits, we had to make a reasonable assumption for future inflation, which is of course unknowable today. The calculation assumes all benefits will increase by 2% each year to account for the annual cost of living adjustment (COLA). The government does this each year to account for inflation.

To answer the question we posed earlier, yes, it is certainly possible to make up for 96 monthly payments that you miss by waiting from age 62 until age 70. In fact, it only takes 10 years for Peter to collect more money by claiming at age 70 than by claiming at any earlier age. By age 80, Peter will have collected $666,400 if he waits until age 70 to claim. If he claims his benefit at age 67, then he will have only collected $658,830 by age 80. If he claims his benefit as early as possible, age 62, then he will have even less with just $636,977. This means the “break-even” age is only 80 years old.

As we have mentioned in the past, one of the biggest risks to an individual’s retirement plan is running out of money in old age. Without appropriate planning, an individual who lives much longer than expected will find that they have depleted their resources and are “outliving” their money. Delaying social security until age 70 can help mitigate this risk. You secure a guaranteed income source for the rest of your life at the highest amount available to you. Move your attention to the far right side of the graph above. If Peter lives to be 101 years old, he would receive $737,530 more social security over his lifetime by delaying until age 70 than if he starts his benefit at age 62. That is 43.8% more money!

Also, when it comes to legally married spouses, keep in mind that when one spouse dies, the surviving spouse always retains the larger benefit. Assume that Peter is married and that his wife did not work outside of the home. She does not qualify for a benefit from her own wage history, but she would qualify for ½ of Peter’s full retirement age benefit. If Peter delays his social security until age 70, but then dies at age 71, all is not lost. Peter’s wife would then receive Peter’s benefit. In other words, if you believe that either you or your spouse will live to be older than age 80 (the break-even age in this example), then you should consider delaying at least one of your benefits until age 70. Odds are pretty good that at least one, if not both of you, will live to be older than 80. Everything beyond that will just be icing on the cake.

James Smith

Financial Planning Associate