In Part III of our series on tax reform, we examine four hypothetical scenarios. The people portrayed are fictional. You should consult your tax professional and financial advisor to understand your specific situation.

To read Part I in our series, describing the basics of the tax reform bill, click here. For Part II – 8 things you can do NOW before the tax bill kicks in, click here.

Want a quick review of your potential tax bill for next year? Click here to use a basic calculator.

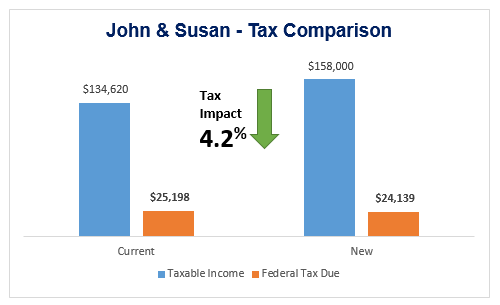

John and Susan

John and Susan are 55 and 53 years old respectively. They have two children, one in a local private high school and another attending Cornell University.

John makes $150,000 a year as an executive with a local manufacturing company. Susan is a teacher and makes $80,000. Both max-out their 401k contributions each year. They live in western New York in a $320,000 home and pay $7,200 in local taxes. Their New York State taxes are in excess of $10,000 per year. They have a mortgage on their home and pay approximately $9,000 in mortgage interest per year. They donate $4,000 to charitable causes each year.

Explanation of Tax Impacts:

Under the new law, John & Susan’s taxable income increases, since they no longer receive personal exemptions and are not able to itemize their deductions. Because they itemized over $31,000 in deductions in 2017, taking the new standard deduction of $24,000 in 2018 increases their taxable income to $158,000. However, under the new law, their marginal tax rate drops from 25% to 22% (effective tax rates drop from 18.7% to 15.3%). Moreover, since they are eligible for child and family tax credits, their final tax bill is $24,139, a savings of $1,059, a modest 4.2% decrease.

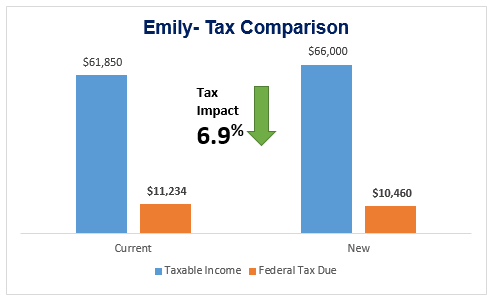

Emily

Emily is single and lives in Lancaster in a $160,000 home. She works in Buffalo making $90,000 a year and contributes approximately $9,000 annually to her 401k. She has no children or dependents. She pays approximately $5,700 in property taxes, carries a mortgage on her home, and reports $4,000 of interest. Emily donates $1,000 per year to charitable organizations.

Explanation of Tax Impacts:

Under current law, Emily itemizes her state and local taxes for approximately $15,100 in total deductions. She receives a personal exemption of $4,050, which, in turn, generates taxable income of $61,850. Emily still itemizes her taxes in 2018, but her marginal tax rate decreases from 25% to 22% (effective rate decreases from 18.2% to 15.9%), resulting in a net tax decrease of $774 (22% of $10,460), or a 6.9% decrease.

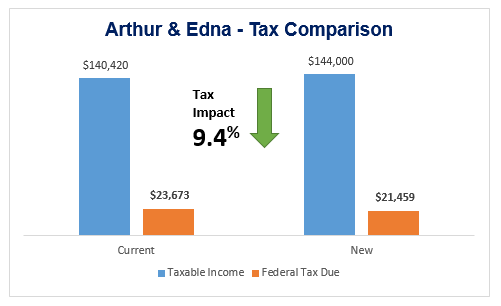

Arthur and Edna

Arthur and Edna are retired and in their mid-70’s. They own their home and do not have a mortgage. They pay approximately $9,000 a year in local property taxes. Over their lifetime, they have managed to save over $3.5 million in assets, of which approximately half is in a traditional IRA, 20% in a Roth IRA, and the remainder in a brokerage account. They spend approximately $80,000 a year in retirement and another $15,000 a year traveling. Their children are grown and living on their own. They donate approximately $10,000 to local charities. Arthur is a retired pediatrician and Edna was a dentist with a former personal practice. They are both collecting Social Security, which they took at full retirement age.

Explanation of Tax Impacts:

Since Arthur and Edna are both retired, collecting full Social Security, and have sizable annual investment and dividend income, their adjusted gross income is over $170,000 per year. Their state income and property taxes are high, but the new cap on state and local taxes limits their ability to itemize both, and therefore they are forced to use the new standard deduction. They can claim an additional $1,250 per person on top of the standard deduction, since they are over the age of 65, bringing their total to $26,500. However, the new rates influence their tax burden significantly, as they move from the 25% marginal rate to the 22% rate (effective rate of 16.9% to 14.2%), reducing their overall federal tax by $2,214, a significant 9.4% decrease.

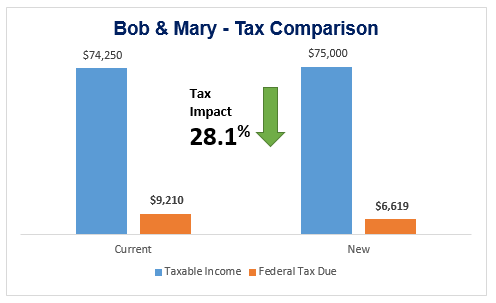

Bob and Mary

Bob is 45 making $50,000 a year as a maintenance technician and Mary is 46 making $60,000 as a manager at a local company. They have one teenage daughter who is sixteen years old. They own a modest $200,000 home in Amherst and pay approximately $3,400 annually in local property taxes. They donate $300 to charity. They contribute 10% annually to their 401k plans.

Explanation of Tax Impacts:

Bob and Mary’s income generates an adjusted gross income of $99,000. Under current law, they can take a $12,000 standard deduction and $12,150 in personal exemptions for a total taxable income of $74,250. Under the new code, even with the standard deduction nearly doubled, the elimination of personal exemptions keeps their taxable income at $75,000. Importantly, since the new tax brackets are expanded, and rates decreased, Bob and Mary enjoy a significant reduction in taxes. Moving from a 25% marginal tax rate to 22% (effective rate of 12.4% to 8.8%), along with the doubling of the child tax credit, lowers their total burden from $9,210 to $6,619, a whopping 28.1% decrease.

These scenarios, fictional of course, show how changes in individual tax rates and standard deductions can have far varying degrees of impact on your tax bill. It’s clear that, for some families, with lower state and local taxes, significant tax relief is possible, at least until 2025 when the rates are set to expire and could actually result in an increase in taxes from today’s rates.

On the other hand, it is clear that many high net worth individuals and married couples will also see some decrease in tax bill, albeit for some, a very insignificant amount.

Each situation is clearly unique. The assumptions used for these scenarios are generic in nature and meant for demonstration purposes only. You should consult your tax professional and financial advisor to understand how the new law will affect your 2018 taxes. Remember, for most, these changes will become real in April 2019 when filers begin preparing their taxes for the 2018 tax year. Plan ahead to minimize your tax burden!

*Level Financial Advisors does not guarantee the accuracy of these projections and individuals should not use these numbers as financial advice. This article should not be considered tax advice and is for educational purposes only.