If you missed either of the first two parts of this three part series on tax-efficient giving strategies, check them out here: Part 1 Part 2

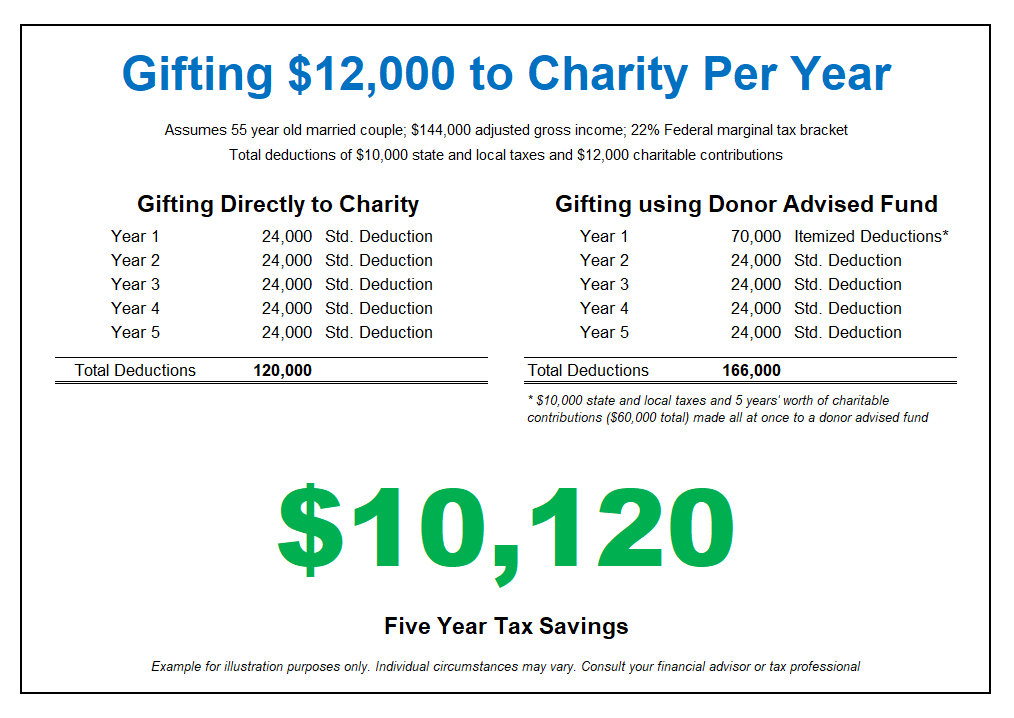

As mentioned in the first two parts of this series, recent tax reform is significantly reducing the number of people who will recognize a tax benefit when making charitable contributions in 2018 and beyond. This is because many people will find that the now-higher standard deduction will be greater than the sum of their now-limited itemized deductions. If this sounds like you, keep reading to learn how a donor advised fund may help you recognize a tax benefit when giving to your favorite charity.

A donor advised fund account is a simple, tax-smart investment solution for charitable giving. Despite its name, it’s not something that only those featured on “Lifestyles of the Rich and Famous” have access to. This is a tool that middle class America can potentially utilize to save thousands on taxes.

The fund is actually an IRS approved 501(c)(3) charity. Because of this, when you contribute to the fund, you receive an immediate tax deduction for the value of your contribution. After that, you control the account to make grants to other approved charities as often as, and for as much as, you would like.

Consider this scenario as an example of how a donor advised fund could benefit someone:

Some features of most donor advised funds:

- Once the money is in the fund, it can be left in cash or invested for growth.

- The investments in the fund and the grants to other charities can be managed completely by you, your advisor, or the parent charitable organization.

- You can contribute cash, securities, or appreciated assets.

- You can make additional contributions at any time.

- There are no minimum annual distribution requirements.

A donor advised fund is different from a private foundation. In fact, you can collapse a private foundation into a donor advised fund if the foundation is dwindling in size, becoming cumbersome to manage, subject to higher fees than necessary, or if you would like to be subject to less requirements around how much money has to be disbursed and when.

A donor advised fund can be a valuable tool to those that are charitably inclined. If it sounds like something that may benefit you, please consult your CERTIFIED FINANCIAL PLANNER™ professional to address your specific situation.

Paul Coleman III, CFP®

Financial Advisor