The investment markets have been mostly calm in 2024 but that quickly changed over the last week as the global stock market took a tumble after receiving disappointing economic and jobs data. This appears to have caught some investors off guard as the prevailing wisdom on interest rate cuts changed abruptly as a result of that data.

Previously, markets had expected a very low chance of any interest rate cuts at all in 2024 given how well the economy and job market was performing. After last week’s data, the markets now expect the Federal Reserve to cut interest rates by 0.25% at the September meeting and potentially another 0.25% before the end of 2024.

What does this new information mean you should do as an investor? The short answer is nothing at all. We have always positioned our portfolios to be widely diversified so that no matter what changes in the markets you have a portion of your portfolio that either benefits or is relatively unaffected.

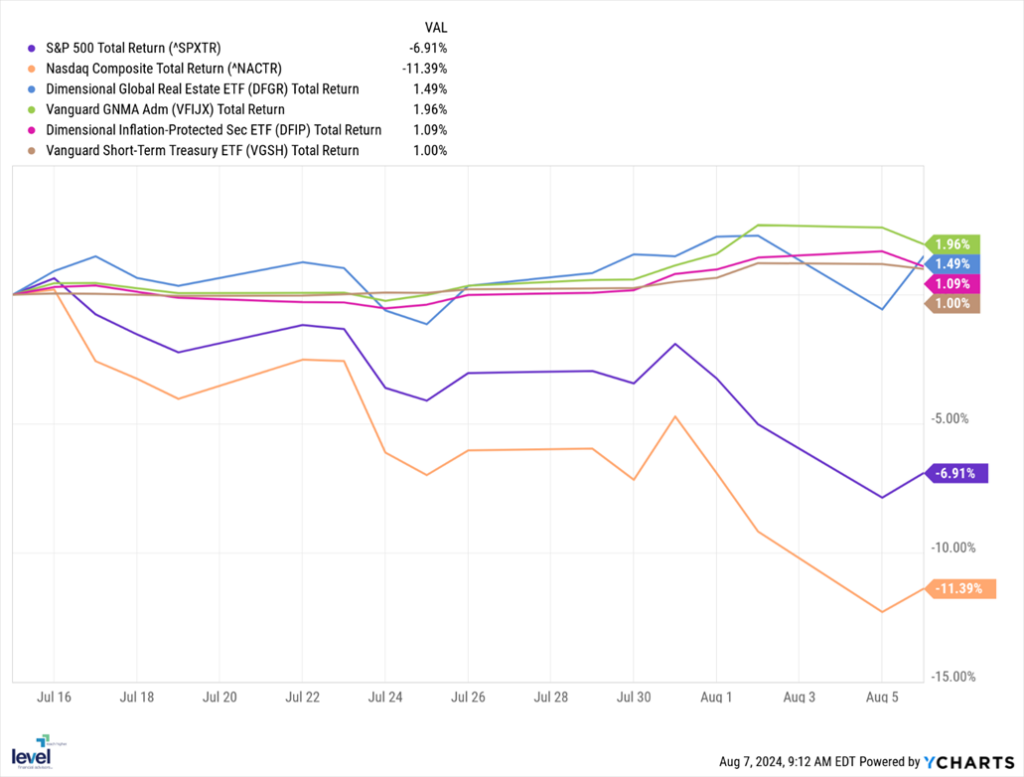

For example, while the S&P is down -7.5% and the Nasdaq is down -12.22% from their highs earlier this year, many of our bond and real estate funds have gone up in value, now that interest rates are expected to decline.

If we take a longer-term view, the last year has been excellent with the global stock market* up 13.20% and US aggregate bond market up 6.74%, despite the recent pullback.

It is important to remember that volatility is normal in the stock and bond markets. Every year has intra-year downturns for various reasons and it is no indication that some major shift is going to happen or that a change in portfolio strategy is warranted. The smartest thing investors can do when the markets are volatile is to stick to their investment plan, remain patient and stay disciplined.

If you wish to discuss the recent market volatility and your portfolio, please don’t hesitate to call your advisor at 716-634-6113 and we would be happy to talk through your personal plan.

*Represented by Vanguard Total Stock ETF (VT)

Steven Elwell, CFP®

Chief Investment Officer & Partner

Disclosures

This article by Level Financial Advisors, Inc. (“Level”) is intended for general information and educational purposes only. No portion of the article serves as the receipt of, or as a substitute for, personalized investment advice from Level or any other investment professional of your choosing. Additionally, please note that guidance from the IRS on this topic is continuing to evolve and the relevant facts may change over time as the IRS rules and regulations change. Before acting on any information contained in this article, it may be necessary to consult with the appropriate professionals to receive individualized advice.

Level is neither a law firm nor accounting firm, and no portion of its services should be construed as legal, accounting, or tax advice. No portion of the content should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Level is engaged, or continues to be engaged, to provide investment advisory services.

A copy of Level’s current written disclosure brochure discussing our advisory services and fees is available upon request or at www.levelFA.com.