The Fed raised interest rates. What happened to your bonds? The value of your bonds will decrease as interest rates increase. Also, the change in interest rates does not affect all bonds equally. The longer the bond’s maturity, the more it is affected by changing interest rates.

If you bought a bond and hold it to maturity, rising interest rates won’t affect the income you receive. You will continue to receive the interest income and will receive the face value of the bond when it matures. For example: If you buy a 10 year bond with a face value of $10,000 at a 5% interest rate, you will receive $500 each year for 10 years. When the bond matures in 10 years you will receive $10,000.

If you need to sell your bond before it matures and interest rates are increasing, the value of your bond could have gone down and you would be selling at a loss. In some instances, there is a benefit to selling your bond at a loss because that loss can be used to offset any realized capital gains. If you don’t have capital gains it can be used to offset up to $3,000 of ordinary income. Any loss that can’t be used in the current tax year can be carried forward and used in the future.

What happens to your bond mutual fund when interest rates increase? Since a bond fund doesn’t have a specific maturity date, the chances are the fund’s total return will go down. Total return encompasses both changes in price and interest rate payments. The value of the bonds held by the fund will fall, negatively affecting total return. The fund will continue to receive the interest payments from the bonds it holds and will pass the interest payments along to the investor. However, bond-fund holders will still likely end up with higher returns over time because, as the bonds in the fund mature, the portfolio manager will reinvest in new bonds with higher interest rates and investors will benefit from increased income. In addition, the interest payments from the bonds in the fund will be reinvested at higher interest rates.

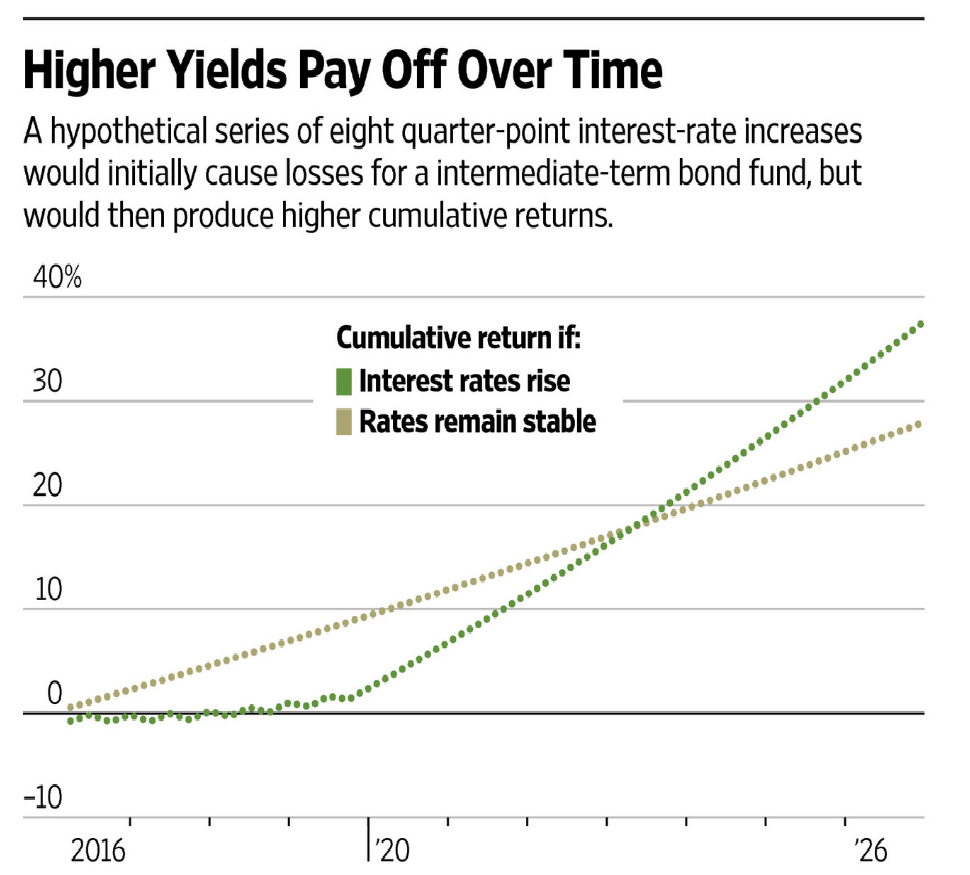

In December 2015 Vanguard looked at the math for a hypothetical investor in an intermediate-term bond fund. For simplicity purposes, Vanguard assumed the Fed raised short-term rates by .25% in January, and then made a similar-sized increase every other quarter through July 2019, for a total increase of two percentage points spread over eight increases.

Under this scenario, a typical intermediate-term bond fund would lose a modest .15% next year, but generate positive yearly returns thereafter. The figures are total returns including price change and income.

Over the first several years, investors would earn less than if rates remained at current levels. But starting in the second quarter of 2023 – more than three years after the end of the rate increases – investors in such a fund would be ahead of where they would have been had there been no rate increases, according to Vanguard.

Another thing to consider is that many bond fund managers have bought shorter-term bonds and have taken other steps to make their portfolios less sensitive to an interest-rate increase.

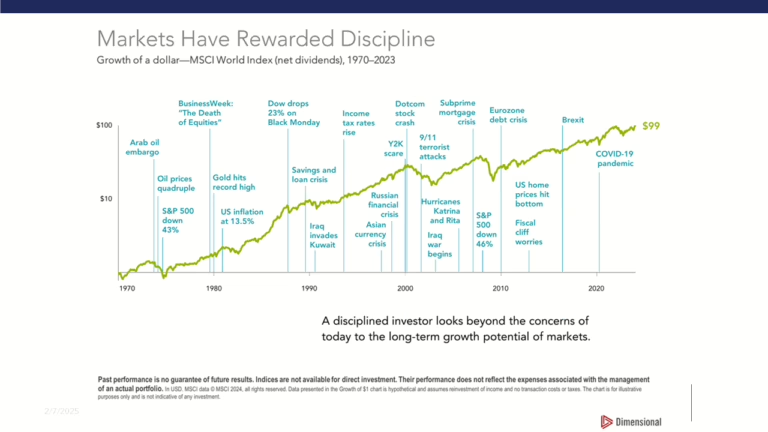

So do you need to do anything with your bonds? We recommend that you sit tight. You may experience a short term decline in your bonds or bond funds, but over the long term you will likely have higher returns.

Rosanne Braxton, CFP® – President