It might feel like whenever the IRS makes a change, your taxes seemingly always increase. A recent change, however, will lower the minimum amount the IRS requires you to withdraw from your retirement accounts. In other words, the IRS lowered Required Minimum Distributions (RMDs). An RMD is the amount the U.S. government requires an individual to withdraw from their traditional IRAs and employer-sponsored retirement plans upon reaching age 72 (it used to be 70 ½ prior to 2020).

RMDs are calculated using the account balance at year end and the account holder’s age, which corresponds with an official “distribution period” that the IRS sets based on average life expectancy. Over time, medical and technological advancements have increased the average life expectancy of an adult. In order to account for increased life expectancy, the IRS has adjusted RMDs so that it will take longer to draw down retirement accounts.

What does this mean? It means that you will be able to keep more money in your retirement accounts over time and pay taxes on those funds at a slower pace. For example, a retiree who is ONLY taking the RMD from their accounts (no other distributions in excess of the minimum), will see their taxable income as a result of RMDs be lower than what it would have been under the old table.

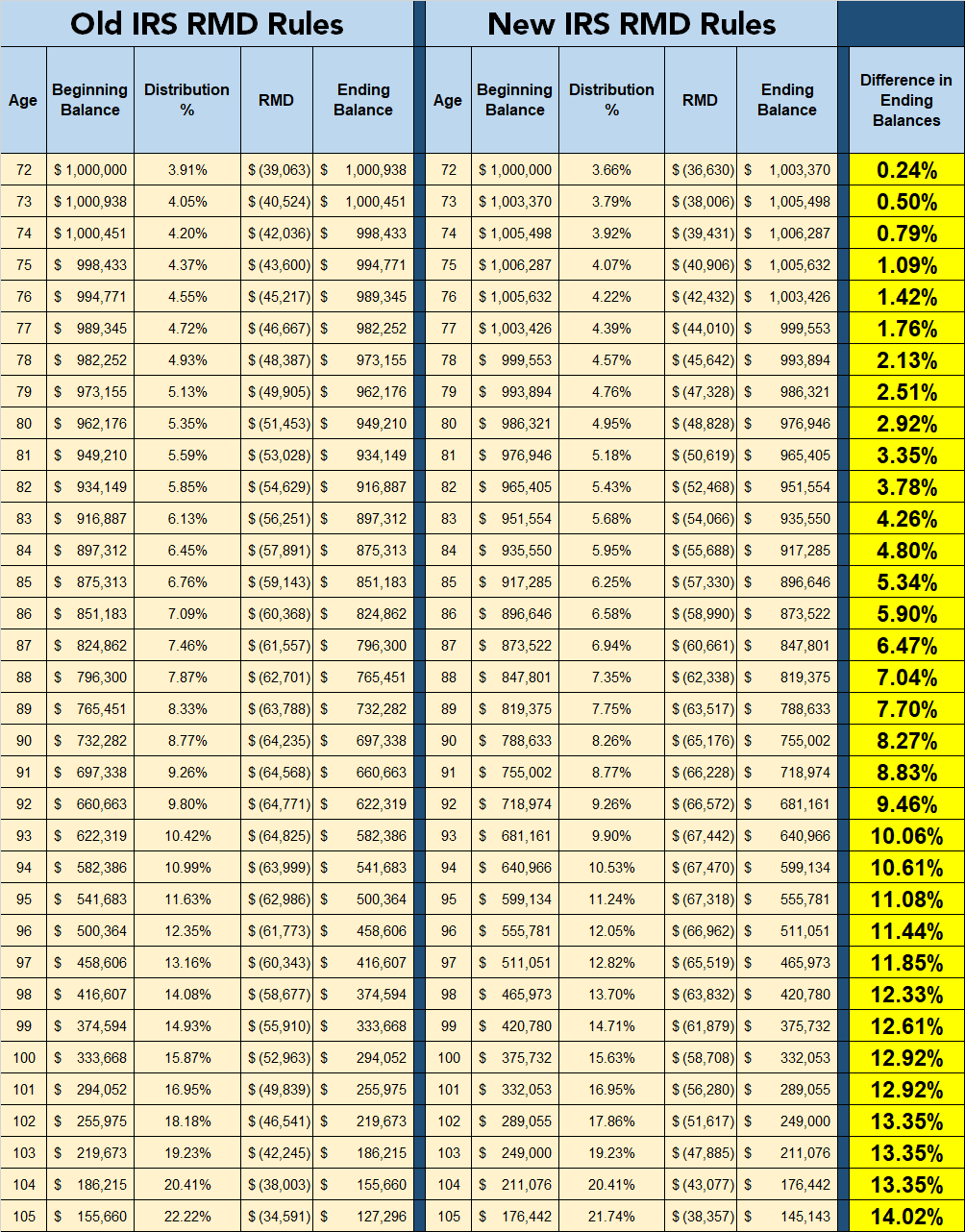

Now that we know more about the nature of RMDs, let’s dive into why this recent change should take some of the pressure off your wallet. To better illustrate how this looks in the real world, we will look at a case study of the fictional Joe Johnson. Joe is age 72 and has accumulated $1,000,000 in his traditional IRA. We will assume that Joe’s IRA will earn 4% returns throughout retirement. In the following table, we will compare what percent of the portfolio balance must be withdrawn per the RMD rules using the old and new table:

You will observe that Joe’s first RMD garners a distribution of 3.91% of his IRA balance using the old distribution parameters and only 3.66% of the balance with the new rules. This 0.25% reduction might seem miniscule at first, however, as the years go on and more money is left in the IRA to continue earning the 4%, the compound effect becomes noticeable and significant.

In the far right column, labeled “Difference in Ending Balances,” we compare what the IRA balance would be at the end of the year under the new rules with the balance at the end of the year under the old rules. After Joe’s first required distribution, the new rules for RMDs result in 0.24% greater oyear-end balance. Again, this does not seem significant, but we are only getting started with Joe’s RMDs. At age 73 Joe takes his second RMD. Now the old vs new distributions amount to 4.05% and 3.79% respectively. The requirement under the new rules is 0.26% less than the old. Still small numbers, yet the difference in the year-end balances between the two hypothetical balances is now 0.5%. Stated differently, Joe’s IRA under the new law is $5,047.11 larger than it would have been under the old laws.

As is the case with compounding, the drastic changes happen exponentially over time. At age 85 Joe’s RMD will have grown to be 6.76% of his portfolio value under the old rules and 6.25% under the new rules. A 0.51% variation. Notably, the new rules have been allowing a little more of Joe’s money to stay in his IRA each year and continue to grow tax deferred at 4%. To better quantify this growth we can see in the far right column that Joe’s IRA balance under the new rules is now 5.34% greater than it would be under the old rules. In this case, that is a $45,462.99 difference. Now, jumping to age 105, you can quickly note that Joe’s IRA balance is suddenly 14.02% larger under the new rules.

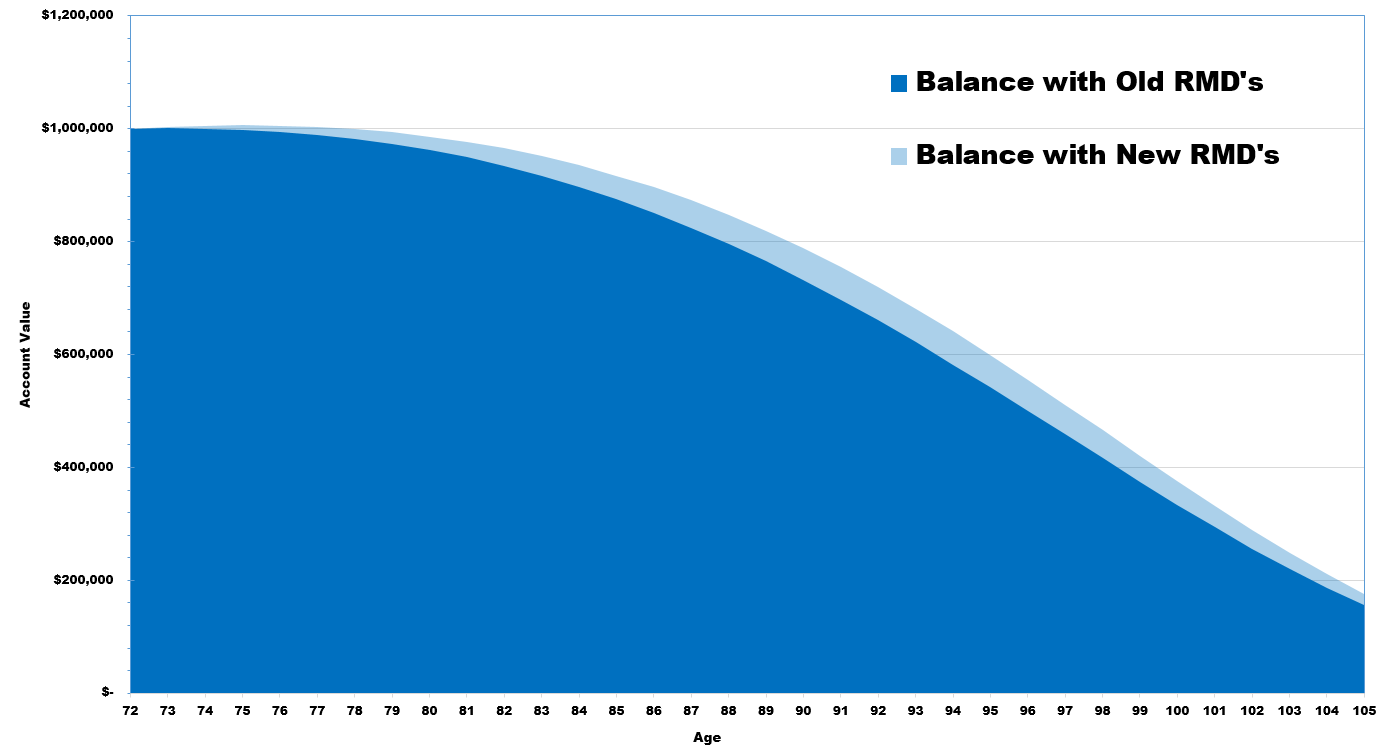

For those of us who are more visual learners, take a look at the following visualization of the difference in Joe’s IRA balance under the old and new RMD laws:

While your eyes might have glazed-over with all the numbers discussed above, the fact of the matter is the new tax rules for the distribution of RMDs allows individuals to leave more money in their accounts to grow tax-deferred longer. The amount of money the government forces you to withdraw at a specific age has been decreased to account for increased life expectancies in today’s world. At the end of the day, that means more control over your retirement accounts and potentially more money in your pocket.

James Smith

Financial Planning Associate