Tale Source: Fidelity.com

Location: Defined in the Merriam-Webster Dictionary as, “a position or site occupied or available for occupancy or marked by some distinguishing feature.”

When I think of the word location, I think of the different places I go to on a day-to-day basis and how they are situated, relative to each other. I think of travel destinations and where I may want to plan trips over the next few years. I think of how close different restaurants are and what the parking situation may be.

When we think of location, we tend to think real world – how are the major pieces of our lives positioned relative to one another? Living in Toronto and commuting to work in Buffalo, for example (approximately a two-hour drive), is not a location decision many people would make. That would be considered extremely inefficient by many.

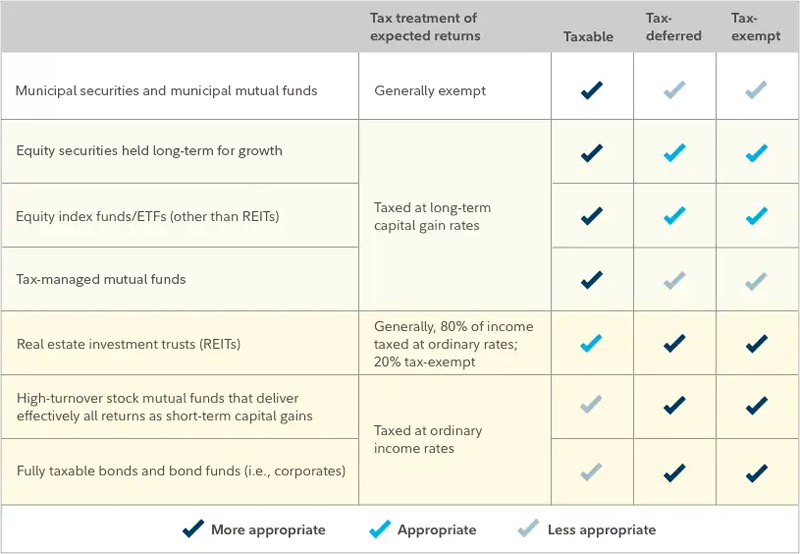

The same concept of balancing location to optimize efficiency applies to investments. Where you hold each investment – that is the type of account holding each specific asset class – has a significant impact on the after-tax return of your portfolio over time.

The average portfolio has multiple accounts. More often than not, the accounts within the portfolio have different tax treatments. The many different funds that comprise a diversified, well-balanced portfolio, spread over multiple account types, also have their own set of tax rules and regulations. Asset location, not to be confused with asset

allocation, is a tax minimization strategy that takes advantage of the different tax rules within a portfolio to maximize the after-tax return of a portfolio.

Asset Location

To better understand the concept of asset location, we need to focus on the three main types of investment accounts that may be found in an average investor’s portfolio.

1. Taxable Accounts. Taxable brokerage

accounts incur tax when the securities held within the accounts (mutual funds, ETFs, individual stocks, bonds, etc.) earn interest or dividends, or when a security that has increased in value is sold for a gain (short-term or long

-term).

2. Tax-Deferred Accounts. Traditional IRAs,

401(k)s, and 403(b)s are common examples of accounts that allow the deferral of taxation of income until the funds are withdrawn later in life. The money that comes out of these accounts are taxed as ordinary income, regardless of the underlying investments held within the accounts.

3. Tax-Exempt Accounts. Roth accounts – Roth

IRAs, Roth 401(k)s, Roth 403(b)s, are all tax-exempt, or “tax-free,” accounts

that require all initial contributions to be made with after-tax dollars. There

is no up-front tax deduction for an investor, but – as the name suggests – withdrawals are allowed 100% tax-free if all the underlying requirements for the specific account are met. Like a tax-deferred account, the tax nature of this account takes priority over the underlying assets held within the account.

Given the different tax rules surrounding each account type – specifically the tax-deferred and tax-exempt accounts that override the tax rules of the underlying securities – we are left with the question: How should my portfolio be invested? With multiple asset classes, each having their own long-term expected returns, risk, and tax treatment, what is the optimal location for all my investments to provide tax efficiency and maximize after-tax returns?

Asset Allocation

Asset allocation is how your portfolio is broken down and invested into each asset class. The three main categories of asset classes are stocks, bonds, and cash or money market securities.

Although there are additional asset classes, including real estate, crypto currency, commodities, etc., we will be focusing on the three primary asset classes that construct an investment portfolio.

The first step in constructing a diversified, well-balanced portfolio is determining what allocation is appropriate for you based on your tolerance for risk, your goals, and time horizon. Once you have worked with your advisor to become comfortable with the concept of asset allocation and what “investment blend” works best for your respective situation, you are ready to apply asset location.

Constructing the Portfolio

Considering proper asset location for your own portfolio is driven by two main components: the tax-efficiency of a security and its expected rate of return over a long-term period. So now you may be asking, what does it mean for a fund to be tax efficient?

The best way to answer this question is by first explaining what is tax inefficient. A tax inefficient investment is one where a significant portion of the return is gained through interest or dividends . Dividends are the profits that a stock or a stock fund pays to investors. For example, the Vanguard S&P 500 Index Fund ETF (ticker VOO) is an extremely popular index fund that, as you may suspect, tracks the S&P 500. Generally, the approximately 500 companies that the fund purchases to track the S&P 500 pay out a share of their profits (dividends) to the shareholders. In this situation, VOO is one of the many shareholders that receive shares of profit from these companies. Subsequently, VOO will accumulate these profits and then distribute them to their shareholders on a quarterly basis (March, June, September, and December).

Given this, bond funds tend to be more inefficient than stock funds because of the interest income that is regularly paid out to investors. This interest income is taxable and will be recorded on your tax return annually. Not only is this income required to be recorded as it is paid out, but it is taxed at your ordinary income tax rate.

Now consider REITs (real estate investment trusts) and REIT funds. A significant portion of anticipated earnings from this specific asset class is derived from dividends because REITs are required to pay out a minimum of 90% of their taxable income in dividends. To further emphasize the tax inefficiency of this asset class, often a portion of the dividends paid out are categorized as nonqualified dividends, meaning they are also taxed at your ordinary income tax rate.

At this point, you have likely started to put the pieces together and thought to yourself, “so that must mean equity (or stock) funds are generally more tax efficient and those should be held in my brokerage account.” Generally speaking, you would be partially correct.

Equity funds are generally more tax-efficient for two reasons: gains (or losses) are not realized until the fund is sold, which in turn will allow you to hold the fund and take advantage of the preferential long-term capital gains rates. Moreover, the dividends paid out to the investor are (generally speaking) qualified in nature, meaning they are also taxed at a more favorable long-term capital gains tax rate.

Where does the Roth fit in?

So far, we have discussed what funds make sense in a taxable account and a tax-deferred account, but what funds are the most appropriate for a Roth IRA or Roth 401(k) that provides tax-free growth?

Adding a third type of account does make the investment picture more complex, but not dramatically so. The tax-free growth nature of a Roth account makes it ideal to hold the least tax-efficient funds with the highest expected returns.

I mentioned earlier that it is only partially correct that equity funds are generally more tax efficient than bonds funds. Non-domestic stock and stock funds (developed markets, emerging markets, etc.) pay out a higher portion of dividends that are nonqualified in nature than a domestic stock or stock fund, such as an S&P 500 index fund.

The least tax-efficient funds with the highest expected return are best suited for tax free growth in a Roth account.

Conclusion

As with any financial planning concept – there is no ‘one size fits all’ answer, and each investor will have their own respective thoughts, attitudes, and feelings that will bring variance to their portfolio. The main idea I want readers to take away from this is the big picture concept of asset allocation. If you are going to independently construct a portfolio, buy asset classes with intentions rather than at random.

Lucas Moshier

Financial Planning Associate