Our firm strives to provide unbiased, objective financial advice to our clients based upon evidence-based analysis. We work in an environment where extremes of emotion, whether euphoric or fearful, can lead to harmful financial decisions. It’s our job to provide a consistent level of disciplined thinking around the topic of money.

Of the two extremes, fear and anxiety seem to be more motivating; it makes us feel like we need to do something, and uncertainty or the unknown is often the root cause.

We have received a fair amount of correspondence from clients who describe our current environment as unprecedented. I think that is a term that most of us can agree on without passing judgement.

For those who are fearful that this will lead to financial pain, please understand, your best interests are completely aligned with ours. So, if there was an action or a strategy that would allow us to accurately avoid market downturns while optimally capturing the recoveries, we would absolutely deploy it. But the evidence just does not support it. As you have heard us say ad nauseum, overwhelming evidence supports a disciplined approach- even in the face of the most distressing “black swan” events.

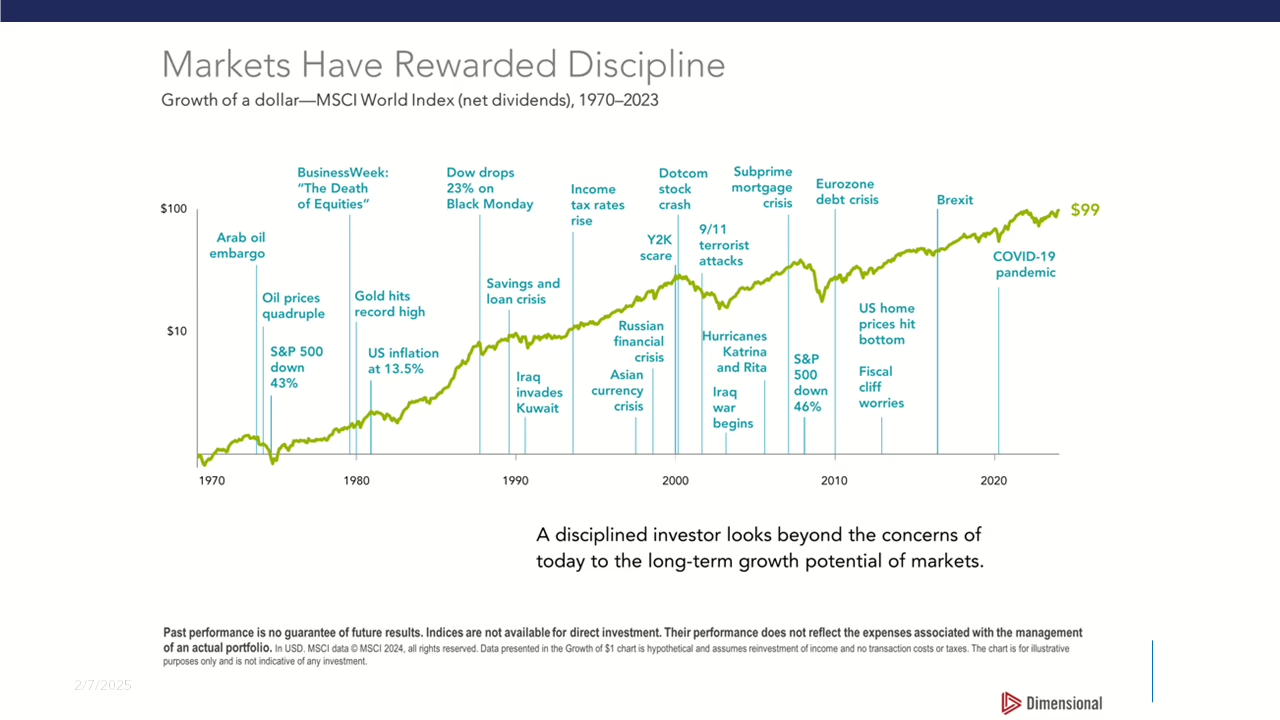

I know you have seen this chart before, but it always makes me feel better to personalize it and place myself into the middle of these difficult, historical events to try and gain some emotional perspective– talk about fear and panic!

I’m pretty “experienced,” so I can remember some of them firsthand. But then the real power of the graph is to see the purely empirical outcome of the recovery and the effects of disciplined investing over time despite the negative events. I’m not suggesting it mitigated personal suffering or tragedies, but those who could stay the course financially were certainly rewarded.

Broadly speaking, “staying the course” means having sufficient liquidity to support your short-term needs in all market conditions and a low cost, globally diversified portfolio of stocks and bonds to outpace inflation over time. As you have no doubt experienced firsthand, your Level Financial advisor will help you finetune and manage a financial plan customized for how you view the world and your unique life circumstances.

We are ready to talk about your concerns and discuss your portfolio any time you are feeling nervous!

Winfred Jacob, CFP®

Senior Financial Advisor